The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing more than 730 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 28th, 2019. What do these smart investors think about L Brands Inc (NYSE:LB)?

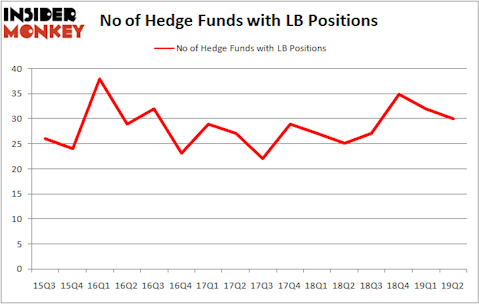

L Brands Inc (NYSE:LB) has seen a decrease in activity from the world’s largest hedge funds lately. LB was in 30 hedge funds’ portfolios at the end of June. There were 32 hedge funds in our database with LB holdings at the end of the previous quarter. Our calculations also showed that LB isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous formulas stock traders use to evaluate their stock investments. A duo of the most useful formulas are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace their index-focused peers by a superb amount (see the details here).

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the new hedge fund action surrounding L Brands Inc (NYSE:LB).

How are hedge funds trading L Brands Inc (NYSE:LB)?

At Q2’s end, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in LB over the last 16 quarters. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in L Brands Inc (NYSE:LB) was held by Renaissance Technologies, which reported holding $114.9 million worth of stock at the end of March. It was followed by D E Shaw with a $85.9 million position. Other investors bullish on the company included Makaira Partners, SRS Investment Management, and Samlyn Capital.

Due to the fact that L Brands Inc (NYSE:LB) has experienced declining sentiment from the aggregate hedge fund industry, we can see that there lies a certain “tier” of hedge funds who were dropping their entire stakes heading into Q3. At the top of the heap, Alexander Mitchell’s Scopus Asset Management cut the largest stake of all the hedgies watched by Insider Monkey, worth about $31.6 million in stock, and Gabriel Plotkin’s Melvin Capital Management was right behind this move, as the fund said goodbye to about $24.8 million worth. These bearish behaviors are important to note, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to L Brands Inc (NYSE:LB). These stocks are Ceridian HCM Holding Inc. (NYSE:CDAY), Wix.Com Ltd (NASDAQ:WIX), Unum Group (NYSE:UNM), and ServiceMaster Global Holdings Inc (NYSE:SERV). All of these stocks’ market caps are closest to LB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDAY | 22 | 845775 | -8 |

| WIX | 26 | 1073011 | -1 |

| UNM | 25 | 493510 | 0 |

| SERV | 30 | 794886 | 6 |

| Average | 25.75 | 801796 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $802 million. That figure was $645 million in LB’s case. ServiceMaster Global Holdings Inc (NYSE:SERV) is the most popular stock in this table. On the other hand Ceridian HCM Holding Inc. (NYSE:CDAY) is the least popular one with only 22 bullish hedge fund positions. L Brands Inc (NYSE:LB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately LB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LB were disappointed as the stock returned -23.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.