Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) from the perspective of those elite funds.

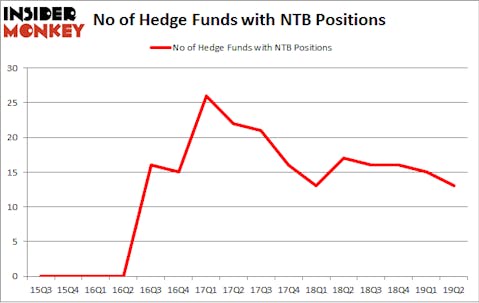

The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) was in 13 hedge funds’ portfolios at the end of June. NTB has experienced a decrease in hedge fund sentiment recently. There were 15 hedge funds in our database with NTB positions at the end of the previous quarter. Our calculations also showed that NTB isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the new hedge fund action encompassing The Bank of N.T. Butterfield & Son Limited (NYSE:NTB).

How have hedgies been trading The Bank of N.T. Butterfield & Son Limited (NYSE:NTB)?

At Q2’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards NTB over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, John Smith Clark’s Southpoint Capital Advisors has the most valuable position in The Bank of N.T. Butterfield & Son Limited (NYSE:NTB), worth close to $67.9 million, comprising 2.6% of its total 13F portfolio. On Southpoint Capital Advisors’s heels is Chuck Royce of Royce & Associates, with a $10.8 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions comprise John Overdeck and David Siegel’s Two Sigma Advisors, Brian Ashford-Russell and Tim Woolley’s Polar Capital and D. E. Shaw’s D E Shaw.

Since The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there were a few money managers that decided to sell off their positions entirely last quarter. It’s worth mentioning that David Costen Haley’s HBK Investments cut the biggest investment of the 750 funds tracked by Insider Monkey, valued at an estimated $0.5 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also dumped its stock, about $0.5 million worth. These bearish behaviors are interesting, as total hedge fund interest dropped by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to The Bank of N.T. Butterfield & Son Limited (NYSE:NTB). We will take a look at Eagle Bancorp, Inc. (NASDAQ:EGBN), Dycom Industries, Inc. (NYSE:DY), Allakos Inc. (NASDAQ:ALLK), and Veoneer, Inc. (NYSE:VNE). This group of stocks’ market values match NTB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EGBN | 11 | 47787 | 0 |

| DY | 17 | 67705 | 0 |

| ALLK | 8 | 176357 | -1 |

| VNE | 12 | 204221 | 4 |

| Average | 12 | 124018 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $124 million. That figure was $121 million in NTB’s case. Dycom Industries, Inc. (NYSE:DY) is the most popular stock in this table. On the other hand Allakos Inc. (NASDAQ:ALLK) is the least popular one with only 8 bullish hedge fund positions. The Bank of N.T. Butterfield & Son Limited (NYSE:NTB) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NTB wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NTB were disappointed as the stock returned -11.4% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.