With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the second quarter of 2021. One of these stocks was Danaher Corporation (NYSE:DHR).

Danaher Corporation (NYSE:DHR) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 81 hedge funds’ portfolios at the end of March. Our calculations also showed that DHR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Medtronic plc (NYSE:MDT), Novo Nordisk A/S (NYSE:NVO), and Costco Wholesale Corporation (NASDAQ:COST) to gather more data points.

In the eyes of most traders, hedge funds are assumed to be unimportant, outdated financial tools of yesteryear. While there are over 8000 funds with their doors open at the moment, Our researchers look at the moguls of this club, approximately 850 funds. Most estimates calculate that this group of people orchestrate bulk of all hedge funds’ total capital, and by paying attention to their inimitable stock picks, Insider Monkey has discovered several investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Daniel Sundheim of D1 Capital Partners

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now we’re going to take a look at the key hedge fund action encompassing Danaher Corporation (NYSE:DHR).

Do Hedge Funds Think DHR Is A Good Stock To Buy Now?

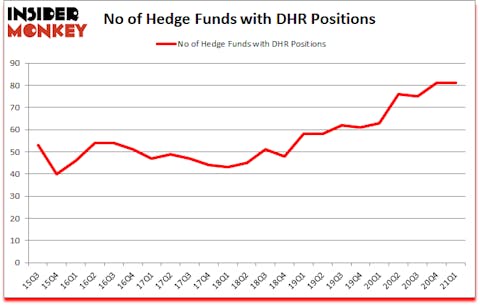

At Q1’s end, a total of 81 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in DHR over the last 23 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Fisher’s Fisher Asset Management has the biggest position in Danaher Corporation (NYSE:DHR), worth close to $722.6 million, corresponding to 0.5% of its total 13F portfolio. Coming in second is Third Point, managed by Dan Loeb, which holds a $652.7 million position; 4.4% of its 13F portfolio is allocated to the stock. Remaining professional money managers that hold long positions include Daniel Sundheim’s D1 Capital Partners, Charles Akre’s Akre Capital Management and Ken Griffin’s Citadel Investment Group. In terms of the portfolio weights assigned to each position Intermede Investment Partners allocated the biggest weight to Danaher Corporation (NYSE:DHR), around 5.08% of its 13F portfolio. D1 Capital Partners is also relatively very bullish on the stock, setting aside 4.42 percent of its 13F equity portfolio to DHR.

Since Danaher Corporation (NYSE:DHR) has faced declining sentiment from the smart money, it’s safe to say that there was a specific group of hedgies who were dropping their positions entirely heading into Q2. Intriguingly, Peter Simmie’s Bristol Gate Capital Partners cut the biggest position of all the hedgies followed by Insider Monkey, comprising about $65.9 million in stock. Michael Platt and William Reeves’s fund, BlueCrest Capital Mgmt., also sold off its stock, about $7.2 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Danaher Corporation (NYSE:DHR) but similarly valued. We will take a look at Medtronic plc (NYSE:MDT), Novo Nordisk A/S (NYSE:NVO), Costco Wholesale Corporation (NASDAQ:COST), T-Mobile US, Inc. (NYSE:TMUS), Citigroup Inc. (NYSE:C), Royal Dutch Shell plc (NYSE:RDS), and Honeywell International Inc. (NYSE:HON). This group of stocks’ market caps resemble DHR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDT | 65 | 3627546 | 6 |

| NVO | 23 | 2929727 | 0 |

| COST | 56 | 4014769 | -5 |

| TMUS | 98 | 9055738 | -5 |

| C | 90 | 6938143 | -5 |

| RDS | 36 | 2190186 | 2 |

| HON | 56 | 1731346 | 11 |

| Average | 60.6 | 4355351 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 60.6 hedge funds with bullish positions and the average amount invested in these stocks was $4355 million. That figure was $5797 million in DHR’s case. T-Mobile US, Inc. (NYSE:TMUS) is the most popular stock in this table. On the other hand Novo Nordisk A/S (NYSE:NVO) is the least popular one with only 23 bullish hedge fund positions. Danaher Corporation (NYSE:DHR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DHR is 73.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 25.8% in 2021 through August 6th and still beat the market by 6.7 percentage points. Hedge funds were also right about betting on DHR as the stock returned 36.6% since the end of Q1 (through 8/6) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Danaher Corp (NYSE:DHR)

Follow Danaher Corp (NYSE:DHR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Youngest Tech Billionaires

- 10 Best Fintech Startups Investors are Flocking To

- 10 Best Dividend Stocks for Passive Income

Disclosure: None. This article was originally published at Insider Monkey.