Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks aren’t doing great but many of the stocks that delivered strong returns since March are still going very strong and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment to GCI Liberty, Inc. (NASDAQ:GLIBA) changed recently.

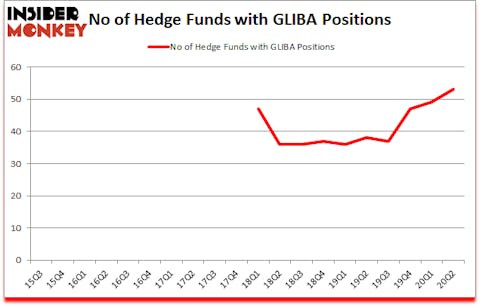

Is GCI Liberty, Inc. (NASDAQ:GLIBA) the right investment to pursue these days? Investors who are in the know were betting on the stock. The number of long hedge fund positions inched up by 4 recently. GCI Liberty, Inc. (NASDAQ:GLIBA) was in 53 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 49. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that GLIBA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 49 hedge funds in our database with GLIBA positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind we’re going to take a look at the key hedge fund action regarding GCI Liberty, Inc. (NASDAQ:GLIBA).

What does smart money think about GCI Liberty, Inc. (NASDAQ:GLIBA)?

At the end of June, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the previous quarter. By comparison, 38 hedge funds held shares or bullish call options in GLIBA a year ago. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, FPR Partners was the largest shareholder of GCI Liberty, Inc. (NASDAQ:GLIBA), with a stake worth $531.4 million reported as of the end of September. Trailing FPR Partners was Eagle Capital Management, which amassed a stake valued at $403.3 million. Hudson Bay Capital Management, D E Shaw, and Foxhaven Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Manor Road Capital Partners allocated the biggest weight to GCI Liberty, Inc. (NASDAQ:GLIBA), around 25.89% of its 13F portfolio. Fort Baker Capital Management is also relatively very bullish on the stock, designating 23.14 percent of its 13F equity portfolio to GLIBA.

Now, specific money managers were leading the bulls’ herd. Islet Management, managed by Joseph Samuels, assembled the largest position in GCI Liberty, Inc. (NASDAQ:GLIBA). Islet Management had $6.9 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also initiated a $6.1 million position during the quarter. The following funds were also among the new GLIBA investors: George Soros’s Soros Fund Management, Donald Sussman’s Paloma Partners, and Minhua Zhang’s Weld Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as GCI Liberty, Inc. (NASDAQ:GLIBA) but similarly valued. These stocks are Snap-on Incorporated (NYSE:SNA), Trex Company, Inc. (NYSE:TREX), Iron Mountain Incorporated (NYSE:IRM), Textron Inc. (NYSE:TXT), The Scotts Miracle-Gro Company (NYSE:SMG), Molson Coors Beverage Company (NYSE:TAP), and Gaming and Leisure Properties Inc (NASDAQ:GLPI). This group of stocks’ market caps resemble GLIBA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNA | 20 | 358773 | -6 |

| TREX | 28 | 221918 | 11 |

| IRM | 22 | 64987 | 3 |

| TXT | 24 | 267696 | 2 |

| SMG | 30 | 307814 | 2 |

| TAP | 36 | 274462 | 2 |

| GLPI | 35 | 498974 | 0 |

| Average | 27.9 | 284946 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27.9 hedge funds with bullish positions and the average amount invested in these stocks was $285 million. That figure was $2178 million in GLIBA’s case. Molson Coors Beverage Company (NYSE:TAP) is the most popular stock in this table. On the other hand Snap-on Incorporated (NYSE:SNA) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks GCI Liberty, Inc. (NASDAQ:GLIBA) is more popular among hedge funds. Our overall hedge fund sentiment score for GLIBA is 89. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and still managed to beat the market by 21 percentage points. Hedge funds were also right about betting on GLIBA, though not to the same extent, as the stock returned 13.5% since the end of June (through October 23rd) and outperformed the market as well.

Follow Grizzly Merger Sub 1 Llc (NASDAQ:GLIBA)

Follow Grizzly Merger Sub 1 Llc (NASDAQ:GLIBA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.