Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going.

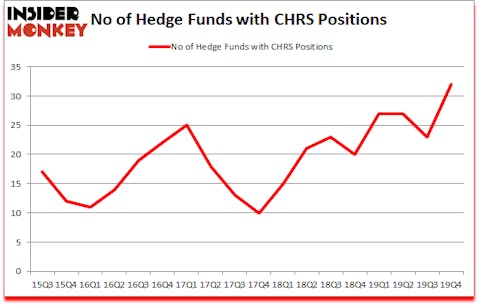

Coherus Biosciences Inc (NASDAQ:CHRS) investors should pay attention to an increase in hedge fund sentiment lately. Our calculations also showed that CHRS isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

According to most traders, hedge funds are assumed to be underperforming, old financial vehicles of the past. While there are over 8000 funds in operation today, We hone in on the elite of this club, around 850 funds. These investment experts oversee bulk of the smart money’s total capital, and by shadowing their unrivaled picks, Insider Monkey has come up with many investment strategies that have historically outpaced the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with 77% accuracy, so we check out his stock picks. A former hedge fund manager is pitching the “next Amazon” in this video; again we are listening. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a peek at the key hedge fund action regarding Coherus Biosciences Inc (NASDAQ:CHRS).

What does smart money think about Coherus Biosciences Inc (NASDAQ:CHRS)?

At Q4’s end, a total of 32 of the hedge funds tracked by Insider Monkey were long this stock, a change of 39% from the third quarter of 2019. By comparison, 20 hedge funds held shares or bullish call options in CHRS a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Rubric Capital Management was the largest shareholder of Coherus Biosciences Inc (NASDAQ:CHRS), with a stake worth $38.3 million reported as of the end of September. Trailing Rubric Capital Management was Rock Springs Capital Management, which amassed a stake valued at $35.1 million. Hound Partners, D E Shaw, and Sio Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Rubric Capital Management allocated the biggest weight to Coherus Biosciences Inc (NASDAQ:CHRS), around 4.33% of its 13F portfolio. Sio Capital is also relatively very bullish on the stock, setting aside 4.06 percent of its 13F equity portfolio to CHRS.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Hawk Ridge Management, managed by David Brown, initiated the most valuable position in Coherus Biosciences Inc (NASDAQ:CHRS). Hawk Ridge Management had $15.8 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $10.7 million investment in the stock during the quarter. The other funds with brand new CHRS positions are Ian Simm’s Impax Asset Management, Ken Greenberg and David Kim’s Ghost Tree Capital, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Coherus Biosciences Inc (NASDAQ:CHRS) but similarly valued. We will take a look at PBF Logistics LP (NYSE:PBFX), Douglas Dynamics Inc (NYSE:PLOW), IMAX Corporation (NYSE:IMAX), and Liberty Oilfield Services Inc. (NYSE:LBRT). This group of stocks’ market caps resemble CHRS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PBFX | 3 | 1492 | 2 |

| PLOW | 12 | 33329 | 1 |

| IMAX | 14 | 46208 | -3 |

| LBRT | 16 | 48897 | 4 |

| Average | 11.25 | 32482 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $32 million. That figure was $235 million in CHRS’s case. Liberty Oilfield Services Inc. (NYSE:LBRT) is the most popular stock in this table. On the other hand PBF Logistics LP (NYSE:PBFX) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Coherus Biosciences Inc (NASDAQ:CHRS) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.3% in 2020 through May 1st but still managed to beat the market by 12.9 percentage points. Hedge funds were also right about betting on CHRS, though not to the same extent, as the stock returned -11% in 2020 (through May 1st) and outperformed the market as well.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.