“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Central Garden & Pet Co (NASDAQ:CENT).

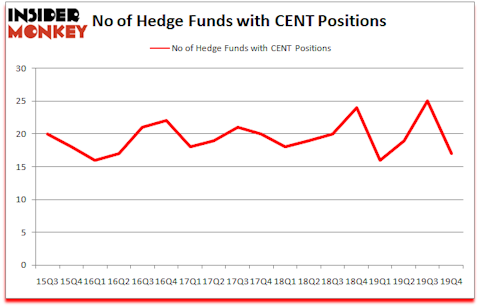

Is Central Garden & Pet Co (NASDAQ:CENT) the right investment to pursue these days? Investors who are in the know are reducing their bets on the stock. The number of long hedge fund positions shrunk by 8 in recent months. Our calculations also showed that CENT isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a look at the new hedge fund action encompassing Central Garden & Pet Co (NASDAQ:CENT).

What does smart money think about Central Garden & Pet Co (NASDAQ:CENT)?

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -32% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CENT over the last 18 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

The largest stake in Central Garden & Pet Co (NASDAQ:CENT) was held by Renaissance Technologies, which reported holding $29.3 million worth of stock at the end of September. It was followed by Armistice Capital with a $25.8 million position. Other investors bullish on the company included D E Shaw, Renaissance Technologies, and Portolan Capital Management. In terms of the portfolio weights assigned to each position Armistice Capital allocated the biggest weight to Central Garden & Pet Co (NASDAQ:CENT), around 1.49% of its 13F portfolio. Portolan Capital Management is also relatively very bullish on the stock, earmarking 1.07 percent of its 13F equity portfolio to CENT.

Due to the fact that Central Garden & Pet Co (NASDAQ:CENT) has faced bearish sentiment from the smart money, it’s safe to say that there was a specific group of hedgies who sold off their positions entirely in the third quarter. At the top of the heap, Greg Poole’s Echo Street Capital Management dropped the biggest stake of the 750 funds monitored by Insider Monkey, comprising close to $17.6 million in stock, and Philippe Laffont’s Coatue Management was right behind this move, as the fund cut about $1.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 8 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Central Garden & Pet Co (NASDAQ:CENT). We will take a look at Veoneer, Inc. (NYSE:VNE), The Cheesecake Factory Incorporated (NASDAQ:CAKE), Heartland Express, Inc. (NASDAQ:HTLD), and Merit Medical Systems, Inc. (NASDAQ:MMSI). This group of stocks’ market caps match CENT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNE | 11 | 150991 | 0 |

| CAKE | 27 | 87474 | 3 |

| HTLD | 14 | 22928 | -4 |

| MMSI | 17 | 80551 | 0 |

| Average | 17.25 | 85486 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $131 million in CENT’s case. The Cheesecake Factory Incorporated (NASDAQ:CAKE) is the most popular stock in this table. On the other hand Veoneer, Inc. (NYSE:VNE) is the least popular one with only 11 bullish hedge fund positions. Central Garden & Pet Co (NASDAQ:CENT) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but still beat the market by 4.2 percentage points. A small number of hedge funds were also right about betting on CENT as the stock returned -2% during the same time period and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.