Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

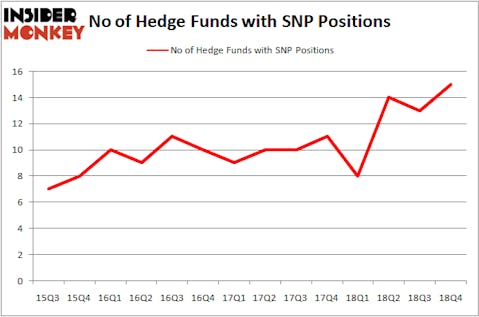

Is China Petroleum & Chemical Corp (NYSE:SNP) a worthy stock to buy now? Prominent investors are becoming more confident. The number of long hedge fund positions improved by 2 in recent months. Our calculations also showed that SNP isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be worthless, old financial vehicles of the past. While there are greater than 8000 funds in operation at present, We look at the moguls of this club, about 750 funds. These money managers have their hands on the majority of the hedge fund industry’s total capital, and by monitoring their finest investments, Insider Monkey has formulated a number of investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s view the latest hedge fund action regarding China Petroleum & Chemical Corp (NYSE:SNP).

How have hedgies been trading China Petroleum & Chemical Corp (NYSE:SNP)?

Heading into the first quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the second quarter of 2018. By comparison, 8 hedge funds held shares or bullish call options in SNP a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in China Petroleum & Chemical Corp (NYSE:SNP) was held by Renaissance Technologies, which reported holding $114.3 million worth of stock at the end of September. It was followed by Arrowstreet Capital with a $52.7 million position. Other investors bullish on the company included LMR Partners, Two Sigma Advisors, and Millennium Management.

Consequently, specific money managers have jumped into China Petroleum & Chemical Corp (NYSE:SNP) headfirst. Millennium Management, managed by Israel Englander, initiated the most valuable position in China Petroleum & Chemical Corp (NYSE:SNP). Millennium Management had $10.8 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $2.2 million position during the quarter. The other funds with brand new SNP positions are Minhua Zhang’s Weld Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks similar to China Petroleum & Chemical Corp (NYSE:SNP). These stocks are Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR), Bristol Myers Squibb Company (NYSE:BMY), CVS Health Corporation (NYSE:CVS), and United Parcel Service, Inc. (NYSE:UPS). All of these stocks’ market caps resemble SNP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PBR | 32 | 1757766 | 4 |

| BMY | 58 | 3871503 | 10 |

| CVS | 77 | 2831097 | 28 |

| UPS | 32 | 1158324 | 1 |

| Average | 49.75 | 2404673 | 10.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49.75 hedge funds with bullish positions and the average amount invested in these stocks was $2405 million. That figure was $237 million in SNP’s case. CVS Health Corporation (NYSE:CVS) is the most popular stock in this table. On the other hand Petroleo Brasileiro S.A. – Petrobras (NYSE:PBR) is the least popular one with only 32 bullish hedge fund positions. Compared to these stocks China Petroleum & Chemical Corp (NYSE:SNP) is even less popular than PBR but hedge fund sentiment is improving. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on SNY as the stock returned 20.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.