Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 750 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Vail Resorts, Inc. (NYSE:MTN).

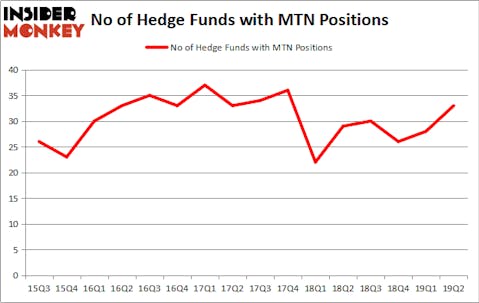

Is Vail Resorts, Inc. (NYSE:MTN) a cheap investment today? Investors who are in the know are in a bullish mood. The number of bullish hedge fund positions improved by 5 lately. Our calculations also showed that MTN isn’t among the 30 most popular stocks among hedge funds (see the video below). MTN was in 33 hedge funds’ portfolios at the end of the second quarter of 2019. There were 28 hedge funds in our database with MTN holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the latest hedge fund action regarding Vail Resorts, Inc. (NYSE:MTN).

How have hedgies been trading Vail Resorts, Inc. (NYSE:MTN)?

At the end of the second quarter, a total of 33 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MTN over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Diamond Hill Capital, managed by Ric Dillon, holds the biggest position in Vail Resorts, Inc. (NYSE:MTN). Diamond Hill Capital has a $106.8 million position in the stock, comprising 0.6% of its 13F portfolio. Coming in second is Point72 Asset Management, managed by Steve Cohen, which holds a $67.7 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Remaining peers that are bullish encompass Robert Joseph Caruso’s Select Equity Group, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors.

Consequently, some big names have jumped into Vail Resorts, Inc. (NYSE:MTN) headfirst. Point72 Asset Management, managed by Steve Cohen, initiated the most valuable position in Vail Resorts, Inc. (NYSE:MTN). Point72 Asset Management had $67.7 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also made a $6.5 million investment in the stock during the quarter. The other funds with brand new MTN positions are Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, Paul Tudor Jones’s Tudor Investment Corp, and Anthony Scaramucci’s Skybridge Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Vail Resorts, Inc. (NYSE:MTN) but similarly valued. These stocks are EQT Midstream Partners LP (NYSE:EQM), DocuSign, Inc. (NASDAQ:DOCU), Aqua America Inc (NYSE:WTR), and Andeavor Logistics LP (NYSE:ANDX). All of these stocks’ market caps are similar to MTN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQM | 8 | 57609 | 0 |

| DOCU | 26 | 327526 | -8 |

| WTR | 21 | 726377 | 6 |

| ANDX | 5 | 34262 | -1 |

| Average | 15 | 286444 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $286 million. That figure was $485 million in MTN’s case. DocuSign, Inc. (NASDAQ:DOCU) is the most popular stock in this table. On the other hand Andeavor Logistics LP (NYSE:ANDX) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Vail Resorts, Inc. (NYSE:MTN) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on MTN, though not to the same extent, as the stock returned 2% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.