Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Dover Corporation (NYSE:DOV) from the perspective of those elite funds.

Is Dover Corporation (NYSE:DOV) the right pick for your portfolio? Prominent investors are taking a bullish view. The number of long hedge fund bets improved by 6 in recent months. Our calculations also showed that DOV isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the key hedge fund action regarding Dover Corporation (NYSE:DOV).

What have hedge funds been doing with Dover Corporation (NYSE:DOV)?

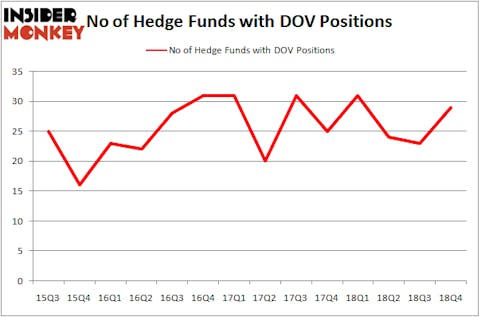

At Q4’s end, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DOV over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Pzena Investment Management, managed by Richard S. Pzena, holds the number one position in Dover Corporation (NYSE:DOV). Pzena Investment Management has a $244.4 million position in the stock, comprising 1.4% of its 13F portfolio. On Pzena Investment Management’s heels is AQR Capital Management, led by Cliff Asness, holding a $61.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism comprise Dan Loeb’s Third Point, Alex Duran and Scott Hendrickson’s Permian Investment Partners and Clint Carlson’s Carlson Capital.

Now, key hedge funds were breaking ground themselves. Carlson Capital, managed by Clint Carlson, created the biggest position in Dover Corporation (NYSE:DOV). Carlson Capital had $25.5 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also initiated a $12.9 million position during the quarter. The other funds with brand new DOV positions are Alexander Mitchell’s Scopus Asset Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Dover Corporation (NYSE:DOV). We will take a look at Conagra Brands, Inc. (NYSE:CAG), Raymond James Financial, Inc. (NYSE:RJF), Varian Medical Systems, Inc. (NYSE:VAR), and Live Nation Entertainment, Inc. (NYSE:LYV). All of these stocks’ market caps are closest to DOV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAG | 33 | 678362 | -5 |

| RJF | 25 | 727652 | -6 |

| VAR | 30 | 803824 | 11 |

| LYV | 37 | 862439 | -1 |

| Average | 31.25 | 768069 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.25 hedge funds with bullish positions and the average amount invested in these stocks was $768 million. That figure was $529 million in DOV’s case. Live Nation Entertainment, Inc. (NYSE:LYV) is the most popular stock in this table. On the other hand Raymond James Financial, Inc. (NYSE:RJF) is the least popular one with only 25 bullish hedge fund positions. Dover Corporation (NYSE:DOV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on Dover as the stock returned 28.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.