Weight Watchers International, Inc. (NYSE:WTW) has been shedding market cap faster than clients drop pounds. Since the fourth quarter of 2012, it’s been a story of disappearing subscribers and slowing growth for this membership-driven weight loss service.

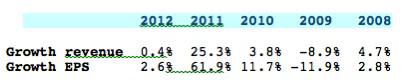

Weight Watchers International, Inc. (NYSE:WTW) rose from its zombie–like performance in 2008-2010 to dazzle the market with lively growth in 2011 and a subsequent resurrection of its market cap and its price. The growth was short lived, and 2012-2013 numbers show a disappearing membership base, especially in the critical North American market.

As revenue growth flat lined with lower earnings and guidance, Weight Watchers International, Inc. (NYSE:WTW) has taken a turn for the worse, and the stock is heading toward three-year lows. The measure Weight Watchers International, Inc. (NYSE:WTW) uses to track success is a number known as total paid weeks. The paid week report is the total of monthly and pay-as-you-go member payments for a reported time period, typically annual and quarterly. When members join up either at meetings or online, these numbers go up. When the company loses members, it goes down.

Paid meeting weeks for North America dropped 5.6% in 2012, along with a decrease of 11.5% in the U.K. Together, these two geographic bases account for 84% of meeting paid weeks–North America alone is 67%. When 84% of a business is underperforming, it’s going to get the market’s attention, and not in a positive way.

The company’s reversal of fortune in 2012- 2013 followed its brief recovery during the back half of 2010 and 2011. Paid weeks increased 26.4% and attendance was up 18.8%. A marketing campaign with Jennifer Hudson as spokesperson and ads that focused on member experience succeeded, driving huge membership gains. Unfortunately, enrollment is now dropping fast, and management blames the loss of members partially on the proliferation of nutrition/weight loss apps that are available either for free or at modest prices.

Business continued to deteriorate in Q2 2013, with North American paid weeks down 10% and member attendance off by 14.5%. Volume is expected to drop by the mid-to-high teens, percentage wise, for the second half of 2013. The UK business was worse, with paid weeks down 19% and the expectation of a second half decline in the mid-to-high 20% range. Margins are expected to contract as spending deleverages with flagging top-line growth. The company has even offered guidance for 2014 — the meeting base will start lower than 2013.

There’s an app for that

If you type in “free weight loss apps,” Google will give you 79 million results in 2.3 seconds. The first page has one of the most popular – MyFitnessPal. It has a free calorie counter and an online diet and fitness community, all completely free, and claims to have 40 million members. Consumers can do it for themselves and at no cost. That’s a powerful threat to Weight Watchers International, Inc. (NYSE:WTW)’s monthly charges for membership; the company’s online program costs $18.95 per month. MyFitnessPal just reeled in venture backing to the tune of $18 million, giving it the potential to become an even more pervasive force in the weight loss niche.

Smart phones give consumers dozens of free options that include calorie counters, calorie consumption by activity, and effective workout routines. Weight Watchers International, Inc. (NYSE:WTW) has conceded slow growth with heavy mobile app adoption in the near-term stealing its market, but also expects members will come back to the organized supportive meeting structure it provides.