Whetstone Capital Advisors is a fund managed by David Atterbury, which reported an equity portfolio worth $170.18 million as of the end of June. The fund invests mainly in energy and even though its returns might had been damaged with the decline of crude prices, a rebound seen this year had a positive impact on the fund’s performance.

According to our methodology of assessing a fund’s returns by calculating the weighted average returns of its long stock positions in companies worth at least $1.0 billion, Whetstone Capital posted gains of 17.70% during the third quarter, based on nine holdings. In this article, we are going to take a closer look at some of the fund’s top picks, including Energy Transfer Equity, L.P. (NYSE:ETE), Criteo SA (ADR) (NASDAQ:CRTO), Williams Companies, Inc. (NYSE:WMB), and Columbia Pipeline Partners LP (NYSE:CPPL).

Let’s start with Energy Transfer Equity, L.P. (NYSE:ETE), in which Whetstone amassed a $25.16 million position, which contained 1.75 million shares at the end of June, up by 92% over the quarter. Whetstone’s optimism in the company paid off pretty well in the following quarter, as Energy Transfer Equity’s stock advanced by 18.9%. At the end of the second quarter, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 3% over the quarter. More specifically, OZ Management was the largest chareholder of Energy Transfer Equity, L.P. (NYSE:ETE), with a stake worth $214.3 million reported as of the end of June. Trailing OZ Management was Corvex Capital, which amassed a stake valued at $93.4 million. OZ Management, Pentwater Capital Management, and Zimmer Partners also held valuable positions in the company.

Follow Energy Transfer Lp (NYSE:ET)

Follow Energy Transfer Lp (NYSE:ET)

Receive real-time insider trading and news alerts

On the other hand, Criteo SA (ADR) (NASDAQ:CRTO)‘s stock slid by 23.5% in the third quarter, while Whetstone entered the quarter with a stake initiated between April and June, which contained 34,311 shares worth $1.58 million. Overall, 13 investors tracked by Insider Monkey were bullish on Criteo SA (ADR) (NASDAQ:CRTO), a decline of 7% over the quarter. Among these funds, Eton Park Capital held the most valuable stake in Criteo, which was worth $48.5 million at the end of the second quarter. On the second spot was York Capital Management which amassed $36 million worth of shares. Moreover, Marshall Wace LLP, Columbus Circle Investors, and Polar Capital were also bullish on Criteo SA (ADR) (NASDAQ:CRTO).

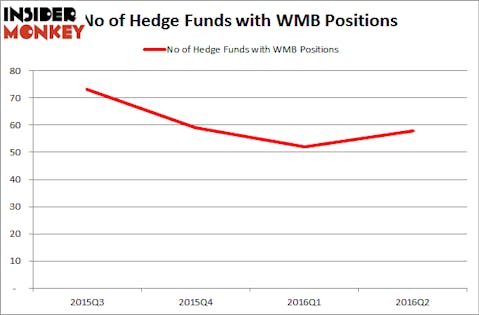

Let’s move on to Williams Companies, Inc. (NYSE:WMB), in which Whetstone cut its stake by 17% to 731,354 shares during the second quarter; the stake was valued at $15.82 million at the end of June. During the third quarter, Williams’ stock surged by 43.1%, having a positive impact on the returns of 58 funds tracked by Insider Monkey, which held shares of the company. More specifically, Corvex Capital was the largest shareholder of Williams Companies, Inc. (NYSE:WMB), with a stake worth $901.6 million reported as of the end of June. Trailing Corvex Capital was Soroban Capital Partners, which amassed a stake valued at $454.2 million. Highfields Capital Management, Steadfast Capital Management, and Millennium Management also held valuable positions in the company.

Follow Williams Companies Inc. (NYSE:WMB)

Follow Williams Companies Inc. (NYSE:WMB)

Receive real-time insider trading and news alerts

Columbia Pipeline Partners LP (NYSE:CPPL) represented a new position in Whetstone’s equity portfolio at the end of June, as the fund had acquired 368,788 shares worth $5.53 million. In the following three months, the investor saw the stock gain 9.2%. Including Whetstone, 10 funds from our database were bullish on Columbia Pipeline Partners, up by 11% over the quarter. Among these funds, Magnetar Capital held the most valuable stake in Columbia Pipeline Partners LP (NYSE:CPPL), which was worth $36.5 million at the end of the second quarter. On the second spot was MSDC Management, which amassed $10.2 million worth of shares. Moreover, Whetstone Capital Advisors, Renaissance Technologies, and Millennium Management were also bullish on Columbia Pipeline Partners LP (NYSE:CPPL).

Follow Columbia Pipeline Partners Lp (NYSE:CPPL)

Follow Columbia Pipeline Partners Lp (NYSE:CPPL)

Receive real-time insider trading and news alerts

Disclosure: none