Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Southwest Airlines Co. (NYSE:LUV) in this article.

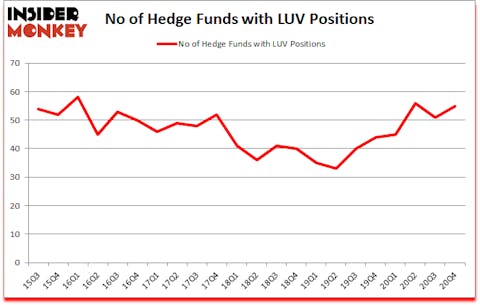

Is Southwest Airlines Co. (NYSE:LUV) going to take off soon? Money managers were getting more bullish. The number of bullish hedge fund positions inched up by 4 in recent months. Southwest Airlines Co. (NYSE:LUV) was in 55 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 58. Our calculations also showed that LUV isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 51 hedge funds in our database with LUV holdings at the end of September.

To most stock holders, hedge funds are seen as worthless, outdated investment tools of the past. While there are greater than 8000 funds in operation at the moment, We hone in on the bigwigs of this group, approximately 850 funds. These investment experts shepherd the lion’s share of the hedge fund industry’s total capital, and by paying attention to their unrivaled investments, Insider Monkey has found several investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to take a gander at the key hedge fund action regarding Southwest Airlines Co. (NYSE:LUV).

Do Hedge Funds Think LUV Is A Good Stock To Buy Now?

At the end of December, a total of 55 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 8% from the third quarter of 2020. By comparison, 44 hedge funds held shares or bullish call options in LUV a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, PAR Capital Management was the largest shareholder of Southwest Airlines Co. (NYSE:LUV), with a stake worth $116.5 million reported as of the end of December. Trailing PAR Capital Management was Orbis Investment Management, which amassed a stake valued at $74.3 million. Renaissance Technologies, Millennium Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Jade Capital Advisors allocated the biggest weight to Southwest Airlines Co. (NYSE:LUV), around 6.02% of its 13F portfolio. PAR Capital Management is also relatively very bullish on the stock, earmarking 3.4 percent of its 13F equity portfolio to LUV.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. Athanor Capital, managed by Parvinder Thiara, initiated the largest position in Southwest Airlines Co. (NYSE:LUV). Athanor Capital had $33.5 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also made a $29.1 million investment in the stock during the quarter. The following funds were also among the new LUV investors: Israel Englander’s Millennium Management, Stephen J. Errico’s Locust Wood Capital Advisers, and Noam Gottesman’s GLG Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Southwest Airlines Co. (NYSE:LUV) but similarly valued. These stocks are Corning Incorporated (NYSE:GLW), Splunk Inc (NASDAQ:SPLK), NatWest Group plc (NYSE:NWG), Nutrien Ltd. (NYSE:NTR), Willis Towers Watson Public Limited Company (NASDAQ:WLTW), Mettler-Toledo International Inc. (NYSE:MTD), and Sirius XM Holdings Inc (NASDAQ:SIRI). All of these stocks’ market caps are closest to LUV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLW | 39 | 334973 | 3 |

| SPLK | 47 | 1036156 | 3 |

| NWG | 3 | 759 | 1 |

| NTR | 25 | 754698 | -1 |

| WLTW | 58 | 3245691 | 7 |

| MTD | 29 | 850200 | -1 |

| SIRI | 32 | 670253 | -5 |

| Average | 33.3 | 984676 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.3 hedge funds with bullish positions and the average amount invested in these stocks was $985 million. That figure was $758 million in LUV’s case. Willis Towers Watson Public Limited Company (NASDAQ:WLTW) is the most popular stock in this table. On the other hand NatWest Group plc (NYSE:NWG) is the least popular one with only 3 bullish hedge fund positions. Southwest Airlines Co. (NYSE:LUV) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for LUV is 84.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on LUV as the stock returned 34.7% since the end of Q4 (through 4/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Southwest Airlines Co (NYSE:LUV)

Follow Southwest Airlines Co (NYSE:LUV)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.