After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of December 31st. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Carvana Co. (NYSE:CVNA).

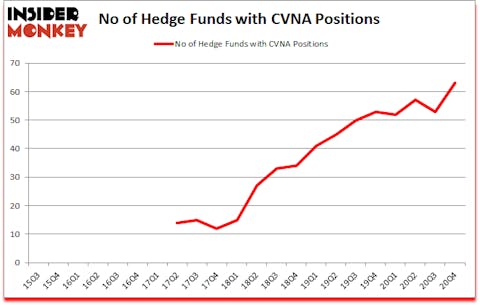

Is Carvana Co. (NYSE:CVNA) going to take off soon? Money managers were turning bullish. The number of long hedge fund bets advanced by 10 in recent months. Carvana Co. (NYSE:CVNA) was in 63 hedge funds’ portfolios at the end of December. The all time high for this statistic was previously 57. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that CVNA isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 53 hedge funds in our database with CVNA positions at the end of the third quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 124 percentage points since March 2017 (see the details here). That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Christian Leone of Luxor Capital Group

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s review the new hedge fund action regarding Carvana Co. (NYSE:CVNA).

Do Hedge Funds Think CVNA Is A Good Stock To Buy Now?

At Q4’s end, a total of 63 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CVNA over the last 22 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Tiger Global Management LLC, managed by Chase Coleman, holds the number one position in Carvana Co. (NYSE:CVNA). Tiger Global Management LLC has a $1.4403 billion position in the stock, comprising 3.7% of its 13F portfolio. Sitting at the No. 2 spot is Spruce House Investment Management, managed by Zachary Sternberg and Benjamin Stein, which holds a $949.4 million position; the fund has 29.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions contain Daniel Sundheim’s D1 Capital Partners, Clifford A. Sosin’s CAS Investment Partners and Lone Pine Capital. In terms of the portfolio weights assigned to each position CAS Investment Partners allocated the biggest weight to Carvana Co. (NYSE:CVNA), around 42.54% of its 13F portfolio. Spruce House Investment Management is also relatively very bullish on the stock, designating 29.05 percent of its 13F equity portfolio to CVNA.

As aggregate interest increased, specific money managers have jumped into Carvana Co. (NYSE:CVNA) headfirst. Lone Pine Capital, established the most outsized position in Carvana Co. (NYSE:CVNA). Lone Pine Capital had $586.5 million invested in the company at the end of the quarter. Tom Purcell and Marco Tablada’s Alua Capital Management also made a $167.9 million investment in the stock during the quarter. The following funds were also among the new CVNA investors: Christian Leone’s Luxor Capital Group, Steve Cohen’s Point72 Asset Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks similar to Carvana Co. (NYSE:CVNA). We will take a look at Baxter International Inc. (NYSE:BAX), CNOOC Limited (NYSE:CEO), Pinterest, Inc. (NYSE:PINS), Thomson Reuters Corporation (NYSE:TRI), Barrick Gold Corporation (NYSE:GOLD), Public Storage (NYSE:PSA), and Match Group, Inc. (NASDAQ:MTCH). This group of stocks’ market valuations resemble CVNA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAX | 42 | 2801959 | -9 |

| CEO | 13 | 197301 | -1 |

| PINS | 95 | 5840185 | 15 |

| TRI | 23 | 360755 | 4 |

| GOLD | 53 | 1751874 | 1 |

| PSA | 31 | 1038430 | 14 |

| MTCH | 72 | 3780895 | 11 |

| Average | 47 | 2253057 | 5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47 hedge funds with bullish positions and the average amount invested in these stocks was $2253 million. That figure was $7072 million in CVNA’s case. Pinterest, Inc. (NYSE:PINS) is the most popular stock in this table. On the other hand CNOOC Limited (NYSE:CEO) is the least popular one with only 13 bullish hedge fund positions. Carvana Co. (NYSE:CVNA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CVNA is 70.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on CVNA as the stock returned 19.1% since the end of Q4 (through 4/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Carvana Co. (NYSE:CVNA)

Follow Carvana Co. (NYSE:CVNA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.