Technology stocks had a lousy start to 2022. QQQ lost 9% of its value in January. Pandemic winners are getting crushed while energy stocks are surging. Roblox lost 36%, Moderna lost 33%, and Carvana and Shopify lost 30% of their values in January. We aren’t certain about the bubbly technology stocks that trade for ridiculously high multiples of their revenues, but we believe top hedge fund stocks will deliver positive returns for the rest of the year. In this article, we will take a closer look at hedge fund sentiment towards Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX) at the end of the third quarter and determine whether the smart money was really smart about this stock.

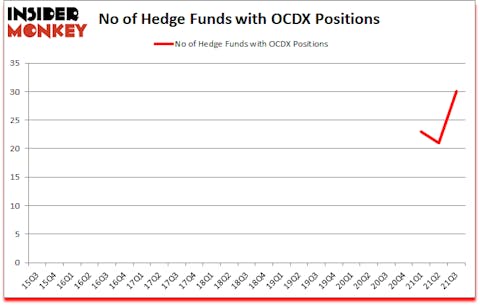

Is Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX) undervalued? Prominent investors were betting on the stock. The number of long hedge fund positions went up by 9 recently. Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX) was in 30 hedge funds’ portfolios at the end of September. The all time high for this statistic was previously 23. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that OCDX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

Dmitry Balyasny of Balyasny Asset Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind let’s review the fresh hedge fund action encompassing Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX).

Do Hedge Funds Think OCDX Is A Good Stock To Buy Now?

At Q3’s end, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from the second quarter of 2021. By comparison, 0 hedge funds held shares or bullish call options in OCDX a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Anand Parekh’s Alyeska Investment Group has the number one position in Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX), worth close to $56 million, corresponding to 0.7% of its total 13F portfolio. Coming in second is Armistice Capital, led by Steven Boyd, holding a $42.5 million position; 0.7% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions include Dmitry Balyasny’s Balyasny Asset Management, Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management and Kamran Moghtaderi’s Eversept Partners. In terms of the portfolio weights assigned to each position Sectoral Asset Management allocated the biggest weight to Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX), around 1.72% of its 13F portfolio. Pinz Capital is also relatively very bullish on the stock, earmarking 1.51 percent of its 13F equity portfolio to OCDX.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Islet Management, managed by Joseph Samuels, established the largest position in Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX). Islet Management had $11.2 million invested in the company at the end of the quarter. Efrem Kamen’s Pura Vida Investments also made a $10.2 million investment in the stock during the quarter. The following funds were also among the new OCDX investors: Alec Litowitz and Ross Laser’s Magnetar Capital, Matthew L Pinz’s Pinz Capital, and Frank Fu’s CaaS Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX) but similarly valued. We will take a look at Fisker Inc. (NYSE:FSR), Qualys Inc (NASDAQ:QLYS), Healthcare Realty Trust Inc (NYSE:HR), Arvinas, Inc. (NASDAQ:ARVN), Murphy USA Inc. (NYSE:MUSA), PS Business Parks Inc (NYSE:PSB), and Enstar Group Ltd. (NASDAQ:ESGR). This group of stocks’ market caps are similar to OCDX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FSR | 15 | 228103 | -1 |

| QLYS | 18 | 220919 | -2 |

| HR | 18 | 210905 | -1 |

| ARVN | 25 | 312887 | -1 |

| MUSA | 17 | 311081 | -9 |

| PSB | 12 | 103720 | -4 |

| ESGR | 14 | 34764 | 3 |

| Average | 17 | 203197 | -2.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $203 million. That figure was $273 million in OCDX’s case. Arvinas, Inc. (NASDAQ:ARVN) is the most popular stock in this table. On the other hand PS Business Parks Inc (NYSE:PSB) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Ortho Clinical Diagnostics Holdings plc (NASDAQ:OCDX) is more popular among hedge funds. Our overall hedge fund sentiment score for OCDX is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Unfortunately, OCDX wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on OCDX were disappointed as the stock returned -6.1% since the end of the third quarter (through 1/31) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as all of these stocks already outperformed the market since 2019.

Follow Ortho Clinical Diagnostics Holdings Plc (NASDAQ:OCDX)

Follow Ortho Clinical Diagnostics Holdings Plc (NASDAQ:OCDX)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Data Stocks to Buy Now

- 10 Best Renewable Energy Stocks to Buy Now

- 10 Best Money Saving Tips According to Experts

Disclosure: None. This article was originally published at Insider Monkey.