Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Dollar Tree, Inc. (NASDAQ:DLTR).

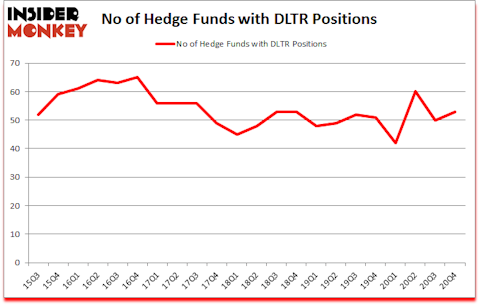

Dollar Tree, Inc. (NASDAQ:DLTR) was in 53 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 65. DLTR has experienced an increase in activity from the world’s largest hedge funds recently. There were 50 hedge funds in our database with DLTR positions at the end of the third quarter. Our calculations also showed that DLTR isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

To the average investor there are dozens of tools shareholders use to appraise publicly traded companies. A couple of the best tools are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the best picks of the best investment managers can trounce the S&P 500 by a significant amount (see the details here). Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a look at the recent hedge fund action encompassing Dollar Tree, Inc. (NASDAQ:DLTR).

Do Hedge Funds Think DLTR Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 53 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from one quarter earlier. On the other hand, there were a total of 51 hedge funds with a bullish position in DLTR a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Akre Capital Management held the most valuable stake in Dollar Tree, Inc. (NASDAQ:DLTR), which was worth $489 million at the end of the fourth quarter. On the second spot was Rivulet Capital which amassed $255.1 million worth of shares. Kensico Capital, Adage Capital Management, and Brave Warrior Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Rivulet Capital allocated the biggest weight to Dollar Tree, Inc. (NASDAQ:DLTR), around 12.63% of its 13F portfolio. KG Funds Management is also relatively very bullish on the stock, setting aside 6.34 percent of its 13F equity portfolio to DLTR.

As one would reasonably expect, some big names have been driving this bullishness. Dorsal Capital Management, managed by Ryan Frick and Oliver Evans, established the most outsized position in Dollar Tree, Inc. (NASDAQ:DLTR). Dorsal Capital Management had $75.6 million invested in the company at the end of the quarter. Anand Parekh’s Alyeska Investment Group also made a $43 million investment in the stock during the quarter. The other funds with brand new DLTR positions are Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, Zach Schreiber’s Point State Capital, and Kamyar Khajavi’s MIK Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Dollar Tree, Inc. (NASDAQ:DLTR) but similarly valued. These stocks are Skyworks Solutions Inc (NASDAQ:SWKS), First Republic Bank (NYSE:FRC), Hormel Foods Corporation (NYSE:HRL), D.R. Horton, Inc. (NYSE:DHI), Weyerhaeuser Co. (NYSE:WY), ZTO Express (Cayman) Inc. (NYSE:ZTO), and PG&E Corporation (NYSE:PCG). This group of stocks’ market valuations are similar to DLTR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SWKS | 41 | 763595 | -9 |

| FRC | 34 | 1270095 | 3 |

| HRL | 31 | 523117 | 1 |

| DHI | 64 | 1922728 | 2 |

| WY | 40 | 614210 | -1 |

| ZTO | 17 | 426129 | -5 |

| PCG | 66 | 6651557 | -10 |

| Average | 41.9 | 1738776 | -2.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.9 hedge funds with bullish positions and the average amount invested in these stocks was $1739 million. That figure was $1977 million in DLTR’s case. PG&E Corporation (NYSE:PCG) is the most popular stock in this table. On the other hand ZTO Express (Cayman) Inc. (NYSE:ZTO) is the least popular one with only 17 bullish hedge fund positions. Dollar Tree, Inc. (NASDAQ:DLTR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for DLTR is 69.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and beat the market again by 1.6 percentage points. Unfortunately DLTR wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on DLTR were disappointed as the stock returned 6.3% since the end of December (through 4/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Dollar Tree Inc. (NASDAQ:DLTR)

Follow Dollar Tree Inc. (NASDAQ:DLTR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.