The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 887 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2020. What do these smart investors think about Constellation Brands, Inc. (NYSE:STZ)?

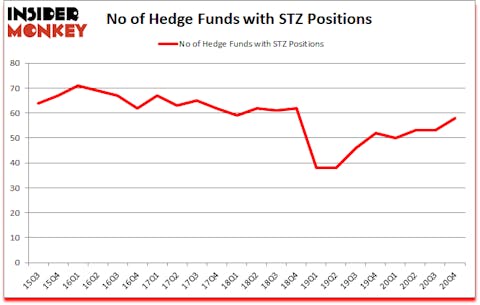

Constellation Brands, Inc. (NYSE:STZ) was in 58 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 71. STZ shareholders have witnessed an increase in hedge fund sentiment recently. There were 53 hedge funds in our database with STZ holdings at the end of September. Our calculations also showed that STZ isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

According to most shareholders, hedge funds are assumed to be slow, old financial vehicles of the past. While there are more than 8000 funds trading at present, We choose to focus on the crème de la crème of this club, about 850 funds. These money managers command the majority of the hedge fund industry’s total capital, and by paying attention to their finest investments, Insider Monkey has discovered several investment strategies that have historically outstripped the broader indices. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

John Overdeck of Two Sigma Advisors

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s check out the key hedge fund action regarding Constellation Brands, Inc. (NYSE:STZ).

Do Hedge Funds Think STZ Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 58 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the previous quarter. On the other hand, there were a total of 52 hedge funds with a bullish position in STZ a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Michael Lowenstein’s Kensico Capital has the most valuable position in Constellation Brands, Inc. (NYSE:STZ), worth close to $297.8 million, comprising 6.9% of its total 13F portfolio. Sitting at the No. 2 spot is Palestra Capital Management, managed by Andrew Immerman and Jeremy Schiffman, which holds a $192.5 million position; 3.8% of its 13F portfolio is allocated to the stock. Other peers with similar optimism encompass John Overdeck and David Siegel’s Two Sigma Advisors, Jeffrey Gates’s Gates Capital Management and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position BlueDrive Global Investors allocated the biggest weight to Constellation Brands, Inc. (NYSE:STZ), around 14.01% of its 13F portfolio. Kensico Capital is also relatively very bullish on the stock, dishing out 6.92 percent of its 13F equity portfolio to STZ.

With a general bullishness amongst the heavyweights, key hedge funds were leading the bulls’ herd. Becker Drapkin Management, managed by Matthew Drapkin and Steven R. Becker, established the most valuable position in Constellation Brands, Inc. (NYSE:STZ). Becker Drapkin Management had $8.8 million invested in the company at the end of the quarter. Benjamin A. Smith’s Laurion Capital Management also made a $5.6 million investment in the stock during the quarter. The following funds were also among the new STZ investors: Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Kamyar Khajavi’s MIK Capital, and Graham F. Smith’s Franklin Street Capital.

Let’s also examine hedge fund activity in other stocks similar to Constellation Brands, Inc. (NYSE:STZ). We will take a look at Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG), The Kraft Heinz Company (NASDAQ:KHC), Metlife Inc (NYSE:MET), Roku, Inc. (NASDAQ:ROKU), Align Technology, Inc. (NASDAQ:ALGN), Electronic Arts Inc. (NASDAQ:EA), and National Grid plc (NYSE:NGG). This group of stocks’ market caps resemble STZ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SMFG | 10 | 92749 | 2 |

| KHC | 36 | 11558217 | -3 |

| MET | 37 | 983027 | 1 |

| ROKU | 60 | 3237943 | 1 |

| ALGN | 50 | 2480630 | 3 |

| EA | 50 | 1050954 | -12 |

| NGG | 5 | 352676 | -1 |

| Average | 35.4 | 2822314 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.4 hedge funds with bullish positions and the average amount invested in these stocks was $2822 million. That figure was $1768 million in STZ’s case. Roku, Inc. (NASDAQ:ROKU) is the most popular stock in this table. On the other hand National Grid plc (NYSE:NGG) is the least popular one with only 5 bullish hedge fund positions. Constellation Brands, Inc. (NYSE:STZ) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for STZ is 82.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks gained 13.6% in 2021 through April 30th and beat the market again by 1.6 percentage points. Unfortunately STZ wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on STZ were disappointed as the stock returned 10.1% since the end of December (through 4/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Constellation Brands Inc. (NYSE:STZ)

Follow Constellation Brands Inc. (NYSE:STZ)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.