The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Walgreens Boots Alliance Inc (NASDAQ:WBA).

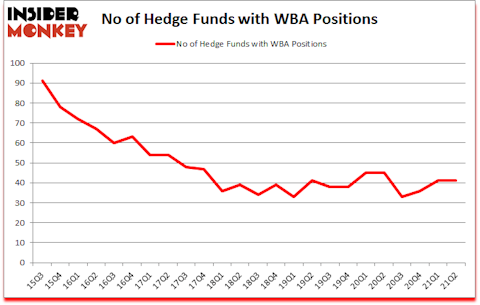

Hedge fund interest in Walgreens Boots Alliance Inc (NASDAQ:WBA) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that WBA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). At the end of this article we will also compare WBA to other stocks including National Grid plc (NYSE:NGG), Koninklijke Philips NV (NYSE:PHG), and Lloyds Banking Group PLC (NYSE:LYG) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). We have been able to outperform the passive index funds by tracking the moves of corporate insiders and hedge funds, and we believe small investors can benefit a lot from reading hedge fund investor letters and 13F filings.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, we like undervalued, EBITDA-positive growth stocks, so we are checking out stock pitches like this emerging biotech stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a look at the fresh hedge fund action surrounding Walgreens Boots Alliance Inc (NASDAQ:WBA).

Do Hedge Funds Think WBA Is A Good Stock To Buy Now?

At Q2’s end, a total of 41 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 45 hedge funds with a bullish position in WBA a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Stephen DuBois’s Camber Capital Management has the largest position in Walgreens Boots Alliance Inc (NASDAQ:WBA), worth close to $184.1 million, comprising 6.2% of its total 13F portfolio. On Camber Capital Management’s heels is Antipodes Partners, led by Jacob Mitchell, holding a $136.2 million position; 4.9% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions consist of Larry Robbins’s Glenview Capital, Andreas Halvorsen’s Viking Global and Ricky Sandler’s Eminence Capital. In terms of the portfolio weights assigned to each position Camber Capital Management allocated the biggest weight to Walgreens Boots Alliance Inc (NASDAQ:WBA), around 6.2% of its 13F portfolio. Antipodes Partners is also relatively very bullish on the stock, dishing out 4.91 percent of its 13F equity portfolio to WBA.

Due to the fact that Walgreens Boots Alliance Inc (NASDAQ:WBA) has experienced bearish sentiment from the smart money, it’s safe to say that there was a specific group of money managers that decided to sell off their full holdings heading into Q3. Intriguingly, Prashanth Jayaram’s Tri Locum Partners cut the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $22 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also said goodbye to its stock, about $21.5 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Walgreens Boots Alliance Inc (NASDAQ:WBA). These stocks are National Grid plc (NYSE:NGG), Koninklijke Philips NV (NYSE:PHG), Lloyds Banking Group PLC (NYSE:LYG), Kimberly Clark Corporation (NYSE:KMB), Constellation Brands, Inc. (NYSE:STZ), T. Rowe Price Group, Inc. (NASDAQ:TROW), and IHS Markit Ltd. (NYSE:INFO). This group of stocks’ market values are similar to WBA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NGG | 7 | 352045 | -2 |

| PHG | 10 | 122622 | -1 |

| LYG | 8 | 16299 | 3 |

| KMB | 37 | 903375 | 6 |

| STZ | 50 | 1607881 | -8 |

| TROW | 24 | 407032 | -2 |

| INFO | 61 | 5947551 | 7 |

| Average | 28.1 | 1336686 | 0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.1 hedge funds with bullish positions and the average amount invested in these stocks was $1337 million. That figure was $1113 million in WBA’s case. IHS Markit Ltd. (NYSE:INFO) is the most popular stock in this table. On the other hand National Grid plc (NYSE:NGG) is the least popular one with only 7 bullish hedge fund positions. Walgreens Boots Alliance Inc (NASDAQ:WBA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for WBA is 50. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 21.8% in 2021 through October 11th and beat the market again by 4.4 percentage points. Unfortunately WBA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on WBA were disappointed as the stock returned -9% since the end of June (through 10/11) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Walgreens Boots Alliance Inc. (NASDAQ:WBA)

Follow Walgreens Boots Alliance Inc. (NASDAQ:WBA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Cryptocurrencies to Invest in According to Hedge Fund Billionaires

- 25 Best Things to Do in NYC During COVID-19

- 10 Best Stocks to Buy According to Chris James’ Engine No. 1

Disclosure: None. This article was originally published at Insider Monkey.