“Market conditions are changing. The continued rise in interest rates suggests we are in the early stages of a bond bear market, which could intensify as central banks withdraw liquidity. The receding tide of liquidity will start to reveal more rocks beyond what has been exposed in emerging markets so far, and the value of a value discipline will be in avoiding the biggest capital-destroying rocks. If a rock emerges on the crowded shore of U.S. momentum, it could result in a major liquidity challenge, as momentum is often most intense on the downside as a crowded trade reverses. So investors are facing a large potential trade-off right now: continue to bet on the current dominance of momentum and the S&P 500, or bet on change and take an active value bet in names with attractive value and optionality, but with negative momentum,” said Clearbridge Investments in its market commentary. We aren’t sure whether long-term interest rates will top 5% and value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards United Bankshares, Inc. (NASDAQ:UBSI).

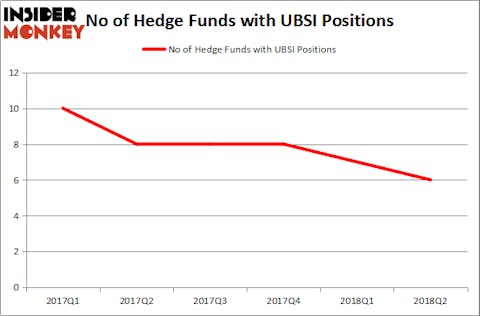

Hedge funds aren’t very excited by what United Bankshares, Inc. (NASDAQ:UBSI) is accomplishing, as two legendary investors sold out of it in Q2, leaving just 6 of the funds in our database long UBSI on June 30. Israel Englander’s Millennium Management and Jim Simons’ Renaissance Technologies each sold out of their UBSI holdings in Q2, giving up the stock’s 4.10% dividend yield and 44 consecutive years of paying dividends, which landed it in the top 10 of the 25 Best Dividend Stocks for Retirement.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Hedge fund activity in United Bankshares, Inc. (NASDAQ:UBSI)

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a 14% decline from the previous quarter. The graph below displays the number of hedge funds with bullish positions in UBSI over the last 6 quarters, which has dropped by 40% to just 6. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Cardinal Capital held the most valuable stake in United Bankshares, Inc. (NASDAQ:UBSI), which was worth $26 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $6.8 million worth of shares. Moreover, Basswood Capital, Navellier & Associates, and BlueCrest Capital Mgmt. were also bullish on United Bankshares, Inc. (NASDAQ:UBSI), allocating a large percentage of their portfolios to this stock.

Judging by the fact that United Bankshares, Inc. (NASDAQ:UBSI) has faced a decline in interest from hedge fund managers, it’s safe to say that there exists a select few hedgies that elected to cut their entire stakes last quarter. Interestingly, Israel Englander’s Millennium Management cut the largest position of all the hedgies monitored by Insider Monkey, worth an estimated $7.9 million in stock, and Jim Simons’ Renaissance Technologies was right behind this move, as the fund dumped about $5.2 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 1 fund last quarter.

Let’s now review hedge fund activity in other stocks similar to United Bankshares, Inc. (NASDAQ:UBSI). These stocks are Equity Commonwealth (NYSE:EQC), Performance Food Group Company (NYSE:PFGC), Ultragenyx Pharmaceutical Inc (NASDAQ:RARE), and Conduent Incorporated (NYSE:CNDT). This group of stocks’ market valuations match UBSI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQC | 24 | 394307 | 3 |

| PFGC | 18 | 220415 | -2 |

| RARE | 11 | 167872 | -2 |

| CNDT | 32 | 926446 | 2 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $427 million. That figure was $44 million in UBSI’s case. Conduent Incorporated (NYSE:CNDT) is the most popular stock in this table. On the other hand Ultragenyx Pharmaceutical Inc (NASDAQ:RARE) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks United Bankshares, Inc. (NASDAQ:UBSI) is even less popular than RARE. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock despite its attractive dividend.

Disclosure: None. This article was originally published at Insider Monkey.