Run Ye, Junji Takegami and Hoyon Hwang‘s Tiger Pacific Capital is one of the 749 hedge funds in our database that filed a 13F for the June 30 SEC reporting period. It was an exceptional quarter for the collection of hedge funds tracked by Insider Monkey, as approximately 95% of them delivered positive returns on the long side of their portfolios, according to our calculations. In this article, we’ll take a look at the returns and some of the interesting stock picks of Tiger Pacific, during that period.

Out of 5 positions in companies valued at $1 billion or more on June 30, Tiger Pacific’s holdings delivered weighted average returns of 18.9% during the third quarter, a big turnaround from the 15.3% losses that its corresponding picks suffered in the second quarter of the year, according to our calculations. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

With that in mind, let’s take a look at the performance of Tiger Pacific’s top picks and see how the fund traded them during the third-quarter as well, as it recently released its 13F for the period.

Noah Holdings Limited (ADR) (NYSE:NOAH) was Tiger Pacific’s top pick on June 30, and remained the fund’s top pick as of September 30, as it held 1.45 million shares at the end of September, down by 5% quarter-over-quarter. The stock returned 8.3% during the third quarter and has been volatile this year. Unfortunately, shares recently tumbled and have given back all of the Q3 gains.

At Q2’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, up from five a quarter earlier. The largest stake in Noah Holdings Limited (ADR) (NYSE:NOAH) was held by Tiger Pacific, and was valued at $36.6 million at the end of June. It was followed by Ariose Capital with a $7.5 million position. Other investors bullish on the company included Keywise Capital Management, Millennium Management, and HBK Investments.

Follow Noah Holdings Ltd (NYSE:NOAH)

Follow Noah Holdings Ltd (NYSE:NOAH)

Receive real-time insider trading and news alerts

Now let’s move on to Autohome Inc (ADR) (NYSE:ATHM), another of the fund’s China-based stock picks. Tiger Pacific again trimmed some of its stake in the strong-performing equity, which returned 20.6% during the third quarter. The fund’s position stood at 1.27 million shares on September 30, down by 4% from the end of June. A Special Committee recently withdrew its going private proposal dated April 16 and was dissolved.

14 of the hedge funds tracked by Insider Monkey were bullish on this stock as of June 30, a 27% jump from one quarter earlier. Among these funds, Select Equity Group held the most valuable stake in Autohome Inc (ADR) (NYSE:ATHM), which was worth $42 million at the end of the second quarter. On the second spot was Tiger Pacific Capital’s $26.6 million position. D E Shaw, Tairen Capital, and Two Sigma Advisors were also bullish on Autohome Inc (ADR) (NYSE:ATHM).

Head to the next page for a look at two more stock picks of Tiger Pacific.

We’re next going to analyze Tiger Pacific’s position in Vipshop Holdings Ltd – ADR (NYSE:VIPS), which returned 31.3% during the third quarter. Tiger Pacific took a lot of shares off the table during the quarter, slashing its position by 52% to 927,509 shares. The timing was good to trim its exposure to the stock, as shares have slumped in the fourth-quarter. Vipshop coverage was initiated by JPMorgan at the end of August with a ‘Neutral’ rating and $16 price target.

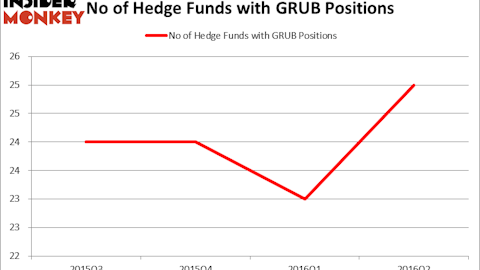

A total of 25 of the hedge funds tracked by Insider Monkey were bullish on the stock on June 30, down by 40% quarter-over-quarter, as hedge funds became bearish on many Chinese equities. Among those funds, Kylin Management held the most valuable stake in Vipshop Holdings Ltd – ADR (NYSE:VIPS), which was worth $243.4 million at the end of the second quarter. On the second spot was Serenity Capital, which had amassed $51 million worth of shares. Moreover, Ivory Capital (Investment Mgmt), Alkeon Capital Management, and Bloom Tree Partners were also bullish on Vipshop Holdings Ltd – ADR (NYSE:VIPS).

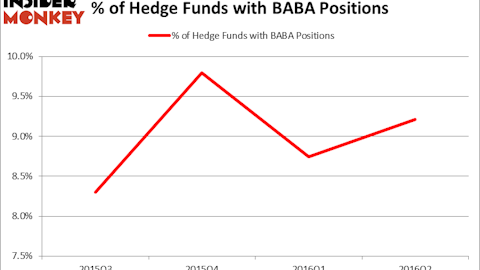

Lastly is Alibaba Group Holding Ltd (NYSE:BABA), the only stock in this list in which Tiger Pacific raised its stake during the third quarter, by 38%. The fund held 228,410 shares of Alibaba on September 30, and those shares returned a hefty 33% during the third quarter. Investors have become more bullish on Alibaba of late, as the stock has pushed above $105 for the first time in nearly two years in late-September.

Heading into the third quarter of 2016, a total of 69 of the hedge funds tracked by Insider Monkey were long Alibaba, a 3% rise from the end of the first quarter of 2016. More specifically, Silver Lake Partners was the largest shareholder of Alibaba Group Holding Ltd (NYSE:BABA), with a stake worth $1.30 billion as of the end of June. Trailing Silver Lake Partners was Viking Global, which had amassed a stake valued at $320.6 million. Discovery Capital Management, Fisher Asset Management, and AQR Capital Management also held valuable positions in the company.

Follow Alibaba Group Holding Limited (NYSE:BABA)

Follow Alibaba Group Holding Limited (NYSE:BABA)

Receive real-time insider trading and news alerts

Disclosure: None