We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of The Walt Disney Company (NYSE:DIS) and Netflix, Inc. (NASDAQ:NFLX) based on that data.

Is The Walt Disney Company (NYSE:DIS) a buy, sell, or hold? Money managers are in a bullish mood. The number of bullish hedge fund positions improved by 11 lately, though our calculations showed that Disney still wasn’t among the 30 most popular stocks among hedge funds. However, it was more popular among billionaire investors, which are pretty much the cream of the crop of the investing world, as it landed 24th on the list of 30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to the beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

How have hedgies been trading The Walt Disney Company (NYSE:DIS)?

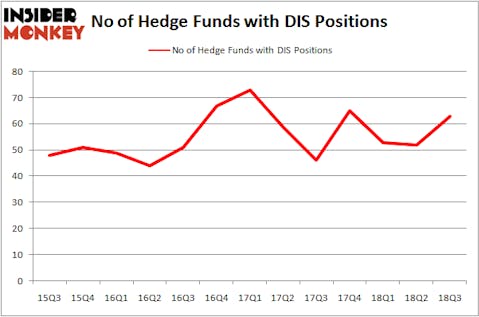

Heading into the fourth quarter of 2018, a total of 63 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 21% rise from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in DIS over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Viking Global held the most valuable stake in The Walt Disney Company (NYSE:DIS), which was worth $1271 million at the end of the third quarter. On the second spot was SRS Investment Management which amassed $890.3 million worth of shares. Moreover, Maverick Capital, Adage Capital Management, and Diamond Hill Capital were also bullish on The Walt Disney Company (NYSE:DIS), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, key hedge funds were breaking ground themselves. Junto Capital Management, managed by James Parsons, assembled the most outsized position in The Walt Disney Company (NYSE:DIS). Junto Capital Management had $44.3 million invested in the company at the end of the quarter. George Soros’s Soros Fund Management also initiated a $35 million position during the quarter. The other funds with brand new DIS positions are D E Shaw, John Lykouretzos’ Hoplite Capital Management, and Ian Simm’s Impax Asset Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Walt Disney Company (NYSE:DIS) but similarly valued. These stocks are Anheuser-Busch InBev SA/NV (NYSE:BUD), NVIDIA Corporation (NASDAQ:NVDA), TOTAL S.A. (NYSE:TOT), and Netflix, Inc. (NASDAQ:NFLX). This group of stocks’ market valuations resemble DIS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BUD | 20 | 1613876 | -1 |

| NVDA | 56 | 4087785 | -1 |

| TOT | 13 | 1101532 | 0 |

| NFLX | 84 | 8777233 | 18 |

As you can see these stocks had an average of 43 hedge funds with bullish positions and the average amount invested in these stocks was $3.90 billion. That figure was $4.91 billion in DIS’s case. Netflix, Inc. (NASDAQ:NFLX) is the most popular stock in this table. On the other hand TOTAL S.A. (NYSE:TOT) is the least popular one with only 13 bullish hedge fund positions. The Walt Disney Company (NYSE:DIS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NFLX, which is in the process of disrupting Disney’s business model, might be a better candidate to consider a long position in.

Disclosure: None. This article was originally published at Insider Monkey.