Retirement planning is an important part of all our lives and affects all and sundry. It pays well to start planning for retirement right from your youth as you will have enough time to plan and prioritize your money in the right channels.

This work can be made much easier with the help of investment advisors who can help you build your financial portfolios. A financial portfolio is a planned demarcation of money into different sorts of investments that can be utilized for getting returns on a variety of platforms.

Earlier, people with money to invest used to ask investment advisors to arrange their investment portfolios. However, in recent times there are robo advisors who can do the trick for you in a jiffy. Now the question arises that what is a robo advisor.

What Is A Robo Advisor?

A robo advisor is a computer algorithm that helps you calculate all the risks and benefits that can be derived from a particular investment mode. It doesn’t cost much and gives you results with a deeper level of analysis.

Earlier, it was observed that people wanted to make optimal use of investment advisors but they were too expensive for them. Hence, the robo advisor was designed with the ultimate aim of providing low cost services to such people who needed services at low costs.

Hence, it must be mentioned that a robo advisor has come as a boon to such people who want a detailed analysis of the market that can help them plan their investments in the correct way.

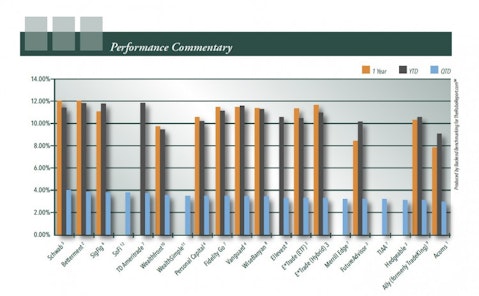

This article gives you a detailed analysis of the top 5 robo advisor apps of 2018 that can help you make the right kind of financial investments at the right place. We also categorize them into different niches that aim to target a particular segment of society.

Read on to find out the different robo advisor apps of 2018 that can help you make your retirement plans the right way.

1. Betterment Robo Advisor

Betterment Robo Advisor is the first robo advisor to come to the market. In current times, it has made its way to the top of the charts. It has the highest volume of assets under its belt with $13.5 billion. This makes it the robo advisor firm with the largest scale of revenue.

The best part about Betterment is that it has very low annual fees ranging from 0.25 to 0.40 per cent of your total. You also get the benefits of availing of an entire year of management based on the amount of your deposit.

Among these different kinds of accounts, a majority of them have a 0.25 percent fee. However, there are some premium accounts where a 0.40 percent fee is charged and they have to maintain an account balance of $ 100,000.

Another good thing about Betterment is that you don’t need to maintain a minimum amount of balance to start a new account. This makes it very welcoming for investors who don’t want to invest too much of money into this venture.

When someone joins Betterment, they have to fill out a form with a short survey. This survey enquires about your investment objectives and risk tolerance. Then this data is fed into the computer to get an automatic investment plan.

In addition to this, Betterment users can make the most use of tax loss harvesting. This will help them get even bigger benefits on your portfolio.

2. Wealthfront

Wealthfront is the best robo advisor for people who are using them for the first time. Most of them pay a low 0.25 percent fees for the management of these accounts. They also have 0.08 APR making it one of the lowest rates for fees.

Wealthfront is one of the most popular apps as it provides newcomers with the facility of having $5000 managed for free. You have the option of investing a smaller section of your portfolio or even distribute it among smaller portfolios without paying anything in fees for management.

Wealthfront also makes use of Modern Portfolio Theory to create low cost returns. It also provides direct indexing for those accounts that have more than $ 100,000 or more in their balance. This gives better tax loss harvesting benefits and helps in better tax management.

3. Schwab Intelligent Portfolios

This is best from a major brokerage point of view. Charles Schwab is one of the best investment companies in the US with $ 23 billion in robo-advising accounts. The best thing about Schwab is that they don’t charge any fees for it all you have to do is $ 5000 opening minimum balance.

You have to fill up a survey form where they will gauge your objectives, tolerance towards risk and timelines. After that, the rest of the work will be done by Schwab who will do an excellent job of allocating your financial portfolio in the correct way.

4. Personal Capital

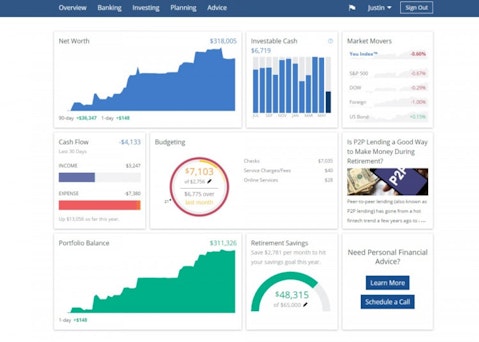

Personal Capital is the best one that also has a human touch. This is because investors get access to a hybrid human and robotic advisor that can help you to select the right kind of portfolio. This is specially targeted to that market segment who does not want to hand all their financial decisions in the hand of a computer. Even though the pricing is higher than other investors, still it is worth it as you are using a human’s knowledge as well. You have to pay 0.89 % for $ 1 million and the price falls a little after that.

5. SoFi Wealth

SoFi Wealth is the best app for student loan borrowers. This is mainly because it was used for returning the loans that students have taken for their education. The best part is that they don’t have to pay any charges for wealth management.

You just need $ 100 to start an account and you pay nothing for up to $ 10,000 portfolio. They also have the added benefit of using human advisors to help them make the right decisions. All this comes for a nominal fee of 0.25 percent making it suitable for new recruits.

Conclusion

This shows the top 5 robo advisor apps of 2018 with an overview of each. This makes it easy for you to choose the right one among them.