Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

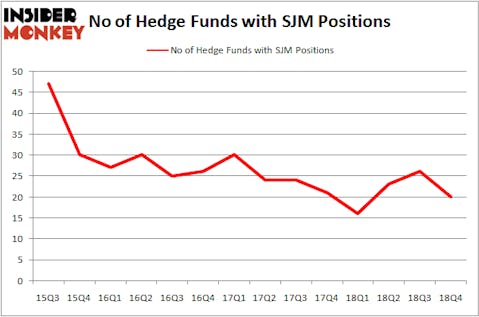

The J.M. Smucker Company (NYSE:SJM) investors should be aware of a decrease in enthusiasm from smart money of late. Our calculations also showed that SJM isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a gander at the recent hedge fund action surrounding The J.M. Smucker Company (NYSE:SJM).

What does the smart money think about The J.M. Smucker Company (NYSE:SJM)?

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in SJM a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Ariel Investments held the most valuable stake in The J.M. Smucker Company (NYSE:SJM), which was worth $148.5 million at the end of the third quarter. On the second spot was Polaris Capital Management which amassed $34.7 million worth of shares. Moreover, Armistice Capital, GAMCO Investors, and Adage Capital Management were also bullish on The J.M. Smucker Company (NYSE:SJM), allocating a large percentage of their portfolios to this stock.

Seeing as The J.M. Smucker Company (NYSE:SJM) has experienced declining sentiment from hedge fund managers, we can see that there is a sect of money managers that elected to cut their positions entirely by the end of the third quarter. It’s worth mentioning that Greg Poole’s Echo Street Capital Management sold off the biggest position of the 700 funds followed by Insider Monkey, comprising about $21.9 million in stock. Clint Carlson’s fund, Carlson Capital, also sold off its stock, about $17.1 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 6 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to The J.M. Smucker Company (NYSE:SJM). These stocks are Devon Energy Corp (NYSE:DVN), TransUnion (NYSE:TRU), W.P. Carey Inc. (NYSE:WPC), and Invitation Homes Inc. (NYSE:INVH). All of these stocks’ market caps are closest to SJM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DVN | 42 | 1168927 | -5 |

| TRU | 28 | 1373120 | -1 |

| WPC | 10 | 49394 | 0 |

| INVH | 16 | 265244 | 1 |

| Average | 24 | 714171 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $714 million. That figure was $273 million in SJM’s case. Devon Energy Corp (NYSE:DVN) is the most popular stock in this table. On the other hand W.P. Carey Inc. (NYSE:WPC) is the least popular one with only 10 bullish hedge fund positions. The J.M. Smucker Company (NYSE:SJM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on SJM, though not to the same extent, as the stock returned 13.9% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.