The 10 Countries With the Lowest Tax Rates in the World: we have come to acknowledge that one of the most common thoughts these days, not only in the US but around the globe, is “why should I pay such high taxes”? Part of this stems from the bloat of governments in developed countries, which tend to have higher tax rates than underdeveloped countries.

Taxes are indeed a crucial element regarding any State’s finances, as in order to run its machinery and operate efficiently providing public health, education, and infrastructure, among other things, it needs a regular income. Nevertheless, some countries have notably lower tax rates than others, and these differences do not always denote a vast difference regarding living standards or quality of infrastructure provided by the local and federal governments.

Some countries have a lower cost of living, with consistent living standards as well. Usually, cost of living indicators take into account variables such as consumer index price as well as tax rates and rent indexes. Some countries indeed have a less expensive cost of living and are always an option for those feeling desensitized to high taxes and cost of living, and wondering whether they can have a better livelihood abroad rather than in their homeland or current country of residence.

For those interested in these countries, we have compiled a list of the 20 Countries With the Lowest Cost of Living in the World, featuring a countdown regarding cost of living, correlated with New York City`s figures. Some of these places, as you might guess are underdeveloped countries, such as Nepal, Algeria, and Vietnam, but some of them have large economies and vibrant markets as well.

This time we have compiled a list with a ranking of countries with the lowest tax rates. The list compares how much countries charge to companies, in relation to their commercial profit. So, which are the ten countries with the lowest tax rates? Read on to find out.

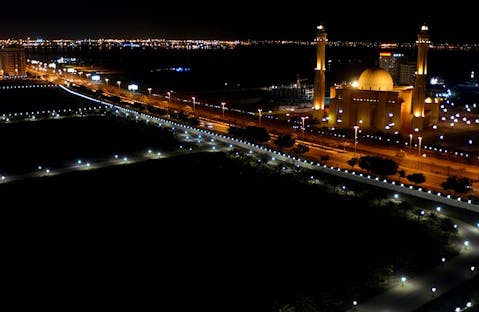

No. 10 Bahrain

Considered one of the top economies in the Middle East, this country has oil and petroleum, which constitute 60% of all exports. The country doesn’t have any tax on profits, although it has a labor tax of 14.6%, plus another 0.4% in miscellaneous taxes.

Our list of countries with the lowest tax rates continues on the next page with another Middle Eastern oil haven.

No. 9 Saudi Arabia

Saudi Arabia is one of the holiest places in the Muslim world, and it owns the second largest reserves of oil in the world. Oil exports account for more than 95% of its exports, and 70% of the government’s revenues. Tax rate is 14.5%, comprised of a 12.4% labor tax and a 2.1% tax on profit.

No. 8 Zambia

This country was named by the World Bank in 2010, to be the fastest economically reformed country in the world. Yet, its economic growth hasn’t met these expectations, as the country is having a hard time coping with the increase in population. With more than 2/3 of its population living below the poverty line, Zambia has started to introduce social programs to deal with the situation. Yet, it charges a 1.5% profit tax, and, among other taxations, total tax burden is 14.5%.

No. 7 United Arab Emirates

Arab countries tend to have a fluent economy given the amount of oil reserves they hold, and the level of exports they carry out through this main product. The United Arab Emirates is no exception to the rule. It holds the seventh largest reserves of oil in the world, and has the 17th largest resource of natural gas. It is a highly developed country, with a dynamic economy. Yet it has a fair total tax rate of 14.1%, which is composed solely of labor tax, as no profit or other taxes are charged.

No. 6 Qatar

One of the richest countries in the world, Qatar has the highest GDP per capita. Moreover, it has one of the highest growth rates and is the most advanced, regarding human development index, in the Arab world. Taxes reach stand at 11.3%, with no profit taxes.

No. 5 Namibia

This country used to be a part of South Africa, but gained its independence in 1990. It is very densely populated, and its main source of revenue is the gold, silver, and uranium industry. Their tax burden is 9.8%, with a 4% tax profit, a 1% tax burden on labor, and 4.8% in other taxes.

No. 4 Macedonia

The country was a part of the former Yugoslavia until 1991, and since its independence it has worked towards creating an open economy, with diversified production. Total tax burden reaches 9.7%. Companies and corporation tax is 6.3%, and profits have a 3.4 % tax rate.

No. 3 Maldives

This island is located in the Indian Ocean and has quite a small population. The main economic activity is tourism, accounting for 28% of Gross Domestic Product. Total tax rate is 9.3%. Yet Maldives doesn’t charge profit taxes or labor taxes.

No. 2 Vanuatu

The island of Vanuatu is located in the South Pacific Ocean, and its economy is mainly driven by agriculture and tourism, along with offshore financial services. Total taxes reach 8.4%, an amount representing a labor tax of 4.5%, and other taxes which account for 3.9% of the total.

No. 1 Timor Leste

Timor Leste used to be a part of Indonesia, until its independence in 2002. The country has recently discovered oil and gas reserves offshore, which are helping with the development of its mainly agricultural economy. Total tax burden is 0.2%, only charging foreign companies’ activities in the country.