Have you ever wondered where the biggest tax havens in the world are located? Tax havens are places in the world where money is largely shielded from taxes. You could think of them as secret jurisdictions, which have international mandates aimed for the primary benefit of non-residents. These jurisdictions create regulations designed to undermine the regulations of other jurisdictions, and develop legally-backed veils of secrecy to protect the identity of people within their regulatory system. Moreover, money movements can be done in large quantities, with total discretion and privacy.

When it comes to people’s savings, some prefer to keep money stashed under the bed, or save it for retirement, while other people prefer to invest it and maybe start a business. There is no doubt some businesses are more profitable than others. Taking a look at The 7 Most Profitable Businesses You Could Start, it is clear that a successful business plan includes choosing the right industry, at the right time, and indeed, making an accurate market analysis. Yet some businesses have higher net profit margins than others. An outpatient care center or payroll service has the highest net profit margins within their industries.

In this list we’ve gathered information regarding the biggest tax havens in the world. Over the past years, numerous governments have tried to tighten their regulations, seeking to control tax evasion within their territories as public outcry has risen over major corporations not paying their fair share of taxes. Nevertheless, these regulations, despite introducing some strict dispositions in numerous countries, weren’t able to keep people from choosing other financial havens to evade taxes and use offshore accounts.

This list on the biggest tax havens in the world was created using the criteria developed by the Financial Secrecy Index, of the Tax Justice Network, which takes into account different key indicators of opacity, from formal banking secrecy, to the characteristics of bank accounts. This index reveals that some of the world’s most important “tax havens” are not small islands in the middle of nowhere, but rather some of the world’s biggest and wealthiest countries. Take a look at our list and find out about these financial paradises!

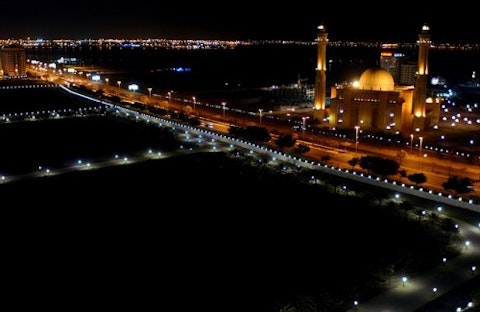

No. 10 Bahrain

This country is located near the Persian Gulf, and is loaded with financial institutions which offer offshore banking services. Bahrain has a Financial Secrecy Index value of 660.3, making this destination one of the top ones regarding financial secrecy.

No. 9 Japan

This country has a secrecy score of 61, and accounts for 1% of the global market for offshore financial services. Its banks don’t subject the deposits made by their clients to interest rate standards and regulations. Japan’s weak provisions on transparency and information exchange have made this country an important destination for illicit financial flows.

No. 8 Germany

Germany has a mid-range secrecy score of 59. This country has quite loose restrictions regarding the opening of offshore bank accounts. Yet, it has been implementing more stringent policies to control the problem of tax evasion. Currently, Germany accounts for about 4% of the global market for offshore financial services.

No. 7 Jersey

This British Crown Dependency has a fiscal security index value of 591.7, with a secrecy score of 75. Jersey has a large number of foreign clients and off shore banking, and investors have been choosing this country for their operations for quite some time now. Yet, Jersey accounts for less than 1% of the global market for offshore financial services.

No. 6 United States

Some states are well-known for their reputation for loose tax regulations. For example, Nevada and Wyoming are two states involved in serious tax evasion issues, due to their regulations. With a fiscal security index value of 1,212.9, the United States accounts for over 22% of the global market for offshore financial services.

No. 5 Singapore

Singapore is an island located in the southeast of Asia. It is considered one of the largest tax havens in the world, with a secrecy score of 70 points, and a Financial Secrecy Index value of 1,216.8. It is growing very fast, and is primed to overtake Switzerland as the world’s largest offshore wealth center by 2020. Opening bank accounts in Singapore is available for almost anyone, and the country accounts for more than 4.3% of the global market for offshore financial services.

No. 4 The Cayman Islands

With a Financial Secrecy Index value of 1,233.5 and a Secrecy score of 70 points, The Cayman Islands in the Caribbean Sea accounts for more than 4% of the global market for offshore financial services. People in the Cayman Islands do not have to pay for personal income taxes, capital gains, corporate taxes or payroll taxes.

No. 3 Hong Kong

Hong Kong is one of the two Special Administrative Regions in the People’s Republic of China. It is one of the world’s largest and fastest growing tax havens, with a Secrecy Score of 72. Moreover, Hong Kong accounts for over 4% of the global market for offshore financial services. Clients don’t pay for sales taxes, capital gains, and payroll taxes.

No. 2 Luxembourg

Luxembourg is a member of the European Union, the United Nations, NATO, Benelux and the OECD, and has a secrecy score of 67. Moreover, Financial Secrecy Index value is 1,454.4, which puts Luxembourg in second position. Currently more than 12% of the global market for offshore accounting and financial services takes place in Luxembourg.

No. 1 Switzerland

Switzerland is number one on the countdown of biggest tax havens. It has a secrecy score of 78, and a FSI value of 1,765.2. This country has an extremely high level of secrecy combined with large scale operations. Offshore bank accounts can have partial or full tax exemptions, depending on the bank in question. According to the Swiss Bankers’ Association, in 2012 there were approximately $2.8 trillion in assets under management in Switzerland.