Wedgewood Partners, an investment management company, released its “Wedgewood Partners Large Cap Focused Growth Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, Wedgewood Composite’s net return was -2.4% compared to the Standard & Poor’s -3.3%, Russell 1000 Growth Index’s -3.1%, and Russell 1000 Value Index’s -3.2% return for the same period. In addition, you can check the top 5 holdings of the fund to know its best picks in 2023.

Wedgewood Partners highlighted stocks like Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in the third quarter 2023 investor letter. Headquartered in Hsinchu City, Taiwan, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is an integrated circuit and other semiconductor device manufacturer. On October 20, 2023, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock closed at $91.31 per share. One-month return of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was 5.88%, and its shares gained 48.98% of their value over the last 52 weeks. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has a market capitalization of $473.571 billion.

Wedgewood Partners made the following comment about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its Q3 2023 investor letter:

“Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) detracted from performance, as revenues declined 10% from a year ago. The Company is lapping revenue growth of over +40% (compared to 2022) during every quarter of 2023, so it is more instructive to look at the health of the business through the lens of a multi-year timeframe. Most of the Company’s customers have seen near-term weakness in demand due to pandemic normalization. However, we think the longer-term trend of more silicon per device is still very much intact, and the Company is well-positioned to serve this, given its commanding market share in leading edge capacity. The Company’s aggressive investment in leading-edge equipment combined with tight development with fabless IC designers, plus the embrace of open development libraries, should continue to foster a superior competitive position and attractive long-term growth.”

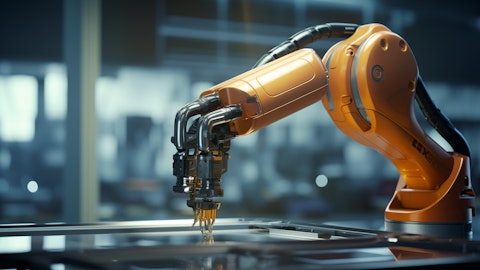

A worker assembling the inner circuitry of a semiconductor product. Editorial photo for a financial news article. 8k. –ar 16:9

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 121 hedge fund portfolios held Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) at the end of second quarter which was 102 in the previous quarter.

We discussed Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article and shared the list of technology stocks to buy that are cheap to ignore. In addition, please check out our hedge fund investor letters Q3 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Biggest Philanthropists in the US in 2023

- 10 Fastest Residency by Investment Programs in the World

- Top 20 Brands Among Gen Z in the US by Mindshare

Disclosure: None. This article is originally published at Insider Monkey.