We recently compiled a list of the 10 Undervalued Chip Stocks Near 52-Week Lows. In this article, we are going to take a look at where Skyworks Solutions Inc (NASDAQ:SWKS) stands against the other undervalued chip stocks.

Energy and EV stocks continue to be in focus as Donald Trump signs a bunch of executive orders that will have far-reaching impacts on many industries. He even revoked an executive order related to AI, though it addresses a matter that may not directly impact a company’s sales in the near term. AI stocks are going under the radar for a few weeks but with earnings season about to get into full gear, we may not have the same opportunities in a couple of weeks that we have now.

Many of the chip stocks continue to stay undervalued. The main reason is the lack of demand in the niche industries that these companies serve. But this demand will eventually shift at some point in 2025, which is what makes them so attractive to consider at this point.

We came up with 10 stocks that we believe are undervalued, near their 52-week lows, and present good investment opportunities. To come up with the 10 undervalued chip stocks that are near 52-week lows, we only considered stocks with a market cap of between $10 billion and $200 billion that hit their 52-week lows recently.

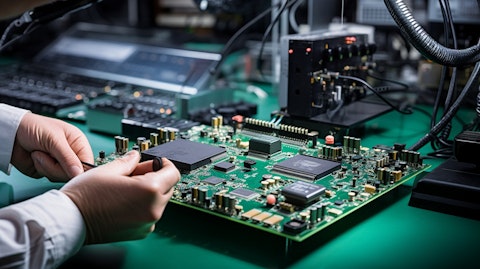

Close-up of Silicon Die are being Extracted from Semiconductor Wafer and Attached to Substrate by Pick and Place Machine. Computer Chip Manufacturing at Fab. Semiconductor Packaging Process.

A technician using a specialized tool to mount a wireless analog system on chip.

Skyworks Solutions Inc (NASDAQ:SWKS)

Skyworks Solutions is a semiconductor products manufacturer that operates in all the major economies of the world. The company makes products like antennas, automotive tuners, digital radios, detectors, modulators, and amplifiers among many other products. Its end markets include aerospace, automotive, defense, entertainment, medical, and industrial sectors.

Skyworks often makes it to the news in relation to Apple Inc, as it is one of the suppliers for the tech giant. The stock spent most of the second half of last year in a downtrend on the back of weakness in its smartphone division. It also lost market share to Qualcomm once the broader market recovered. The stock’s underperformance is fully justified as it struggles to keep up with its competitors in almost all of its segments. Despite a smartphone market that showed the best growth in 5 years, the company’s growth was relatively muted. Its Apple-related business, as well as its Android business, isn’t growing as well as investors would hope.

Having said all the above, the stock is pricing in all of these headwinds that the company is dealing with simultaneously. The average analyst target price of $96.27 is still above the current share price, which means any positive trigger could start a bull run as analysts revise their estimates.

Overall SWKS ranks 6th on our list of the undervalued chip stocks near 52-week lows. While we acknowledge the potential of SWKS as a leading AI investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is as promising as SWKS but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and Complete List of 59 AI Companies Under $2 Billion in Market Cap

Disclosure: None. This article was originally published at Insider Monkey.