At Insider Monkey, we pore over the filings of nearly 750 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not SK Telecom Co., Ltd. (NYSE:SKM) makes for a good investment right now.

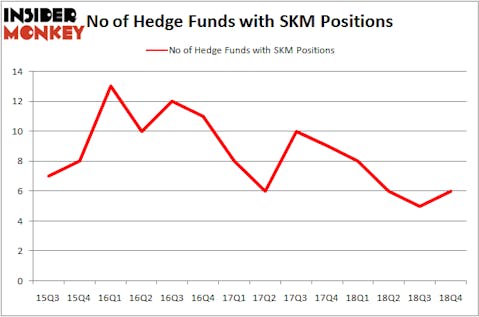

SK Telecom Co., Ltd. (NYSE:SKM) has seen an increase in hedge fund sentiment lately. Our calculations also showed that SKM isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most market participants, hedge funds are seen as worthless, old financial tools of the past. While there are more than 8000 funds with their doors open at the moment, We hone in on the leaders of this club, about 750 funds. These money managers orchestrate the lion’s share of all hedge funds’ total capital, and by observing their first-class equity investments, Insider Monkey has deciphered numerous investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to view the latest hedge fund action encompassing SK Telecom Co., Ltd. (NYSE:SKM).

What have hedge funds been doing with SK Telecom Co., Ltd. (NYSE:SKM)?

At the end of the fourth quarter, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in SKM a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of SK Telecom Co., Ltd. (NYSE:SKM), with a stake worth $57.2 million reported as of the end of September. Trailing Arrowstreet Capital was LMR Partners, which amassed a stake valued at $13.3 million. Sensato Capital Management, D E Shaw, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, key money managers were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, assembled the largest position in SK Telecom Co., Ltd. (NYSE:SKM). Citadel Investment Group had $0.4 million invested in the company at the end of the quarter. Robert B. Gillam’s McKinley Capital Management also made a $0 million investment in the stock during the quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as SK Telecom Co., Ltd. (NYSE:SKM) but similarly valued. We will take a look at Cerner Corporation (NASDAQ:CERN), Microchip Technology Incorporated (NASDAQ:MCHP), Synchrony Financial (NYSE:SYF), and Deutsche Bank Aktiengesellschaft (NYSE:DB). This group of stocks’ market valuations are closest to SKM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CERN | 22 | 642762 | -3 |

| MCHP | 30 | 425995 | 7 |

| SYF | 40 | 2307219 | 5 |

| DB | 14 | 1068433 | 5 |

| Average | 26.5 | 1111102 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.5 hedge funds with bullish positions and the average amount invested in these stocks was $1111 million. That figure was $88 million in SKM’s case. Synchrony Financial (NYSE:SYF) is the most popular stock in this table. On the other hand Deutsche Bank Aktiengesellschaft (NYSE:DB) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks SK Telecom Co., Ltd. (NYSE:SKM) is even less popular than DB. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately SKM wasn’t in this group. Hedge funds that bet on SKM were disappointed as the stock lost 7.6% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.