Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and a 20% drop in stock prices. Things completely reversed in 2019 and stock indices hit record highs. Recent hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards ZTO Express (Cayman) Inc. (NYSE:ZTO) to find out whether it was one of their high conviction long-term ideas.

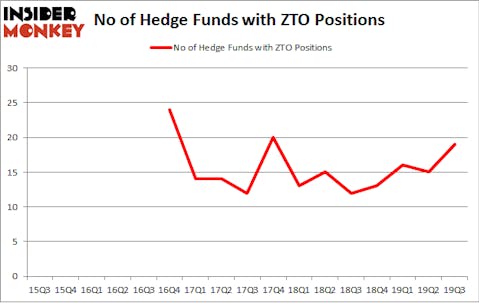

ZTO Express (Cayman) Inc. (NYSE:ZTO) investors should pay attention to an increase in hedge fund sentiment in recent months. ZTO was in 19 hedge funds’ portfolios at the end of the third quarter of 2019. There were 15 hedge funds in our database with ZTO holdings at the end of the previous quarter. Our calculations also showed that ZTO isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a lot of gauges stock traders can use to size up their holdings. A couple of the best gauges are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outperform the market by a significant amount (see the details here).

Kerr Neilson of Platinum Asset Management

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a peek at the recent hedge fund action regarding ZTO Express (Cayman) Inc. (NYSE:ZTO).

How are hedge funds trading ZTO Express (Cayman) Inc. (NYSE:ZTO)?

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 27% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in ZTO a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

More specifically, Platinum Asset Management was the largest shareholder of ZTO Express (Cayman) Inc. (NYSE:ZTO), with a stake worth $300.5 million reported as of the end of September. Trailing Platinum Asset Management was Tairen Capital, which amassed a stake valued at $62.4 million. Renaissance Technologies, Driehaus Capital, and Tiger Global Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tairen Capital allocated the biggest weight to ZTO Express (Cayman) Inc. (NYSE:ZTO), around 9.18% of its 13F portfolio. Platinum Asset Management is also relatively very bullish on the stock, dishing out 6.72 percent of its 13F equity portfolio to ZTO.

There weren’t any hedge funds initiating brand new positions in the stock during the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as ZTO Express (Cayman) Inc. (NYSE:ZTO) but similarly valued. We will take a look at Check Point Software Technologies Ltd. (NASDAQ:CHKP), Arthur J. Gallagher & Co. (NYSE:AJG), Magna International Inc. (NYSE:MGA), and Marvell Technology Group Ltd. (NASDAQ:MRVL). This group of stocks’ market caps match ZTO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CHKP | 20 | 407935 | -4 |

| AJG | 23 | 286963 | -2 |

| MGA | 17 | 432332 | 3 |

| MRVL | 31 | 682428 | -6 |

| Average | 22.75 | 452415 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $452 million. That figure was $505 million in ZTO’s case. Marvell Technology Group Ltd. (NASDAQ:MRVL) is the most popular stock in this table. On the other hand Magna International Inc. (NYSE:MGA) is the least popular one with only 17 bullish hedge fund positions. ZTO Express (Cayman) Inc. (NYSE:ZTO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ZTO wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ZTO investors were disappointed as the stock returned -0.2% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.