Should you buy Shutterfly, Inc. (NASDAQ:SFLY), Yelp Inc (NYSE:YELP), Scientific Games Corp (NASDAQ:SGMS), and/or Expedia Inc (NASDAQ:EXPE)? According to our research, an investor can beat the market by investing in the top picks of big hedge funds. We follow around 750 funds, among which is Eastbay Asset Management, a New York-based investment fund run by Adam Wolfberg and Steven Landry, which had all four of those companies among its top consumer picks. Therefore, we decided to examine these stocks, see how they performed in the third quarter, and what was the general smart money sentiment towards them.

Eastbay Asset Management’s equity portfolio had a value of $404.92 million in managed 13F securities at the end of the second quarter. In the third quarter, the fund’s stock picks returned 17.78% from its 15 long positions in companies having a market cap of at least $1 billion. Let’s take a look at its positions and see how it delivered those strong returns and has traded these stock lately.

Eastbay Asset Management upped its take in Shutterfly, Inc. (NASDAQ:SFLY) by 2% in the second quarter, ending the period with a total of 1.96 million shares of the company, which had a net worth of $90.76 million. The stock however lost 4.2% during the third quarter. At Q2’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a 19% fall from the first quarter of 2016. After Eastbay comes Marathon Partners, which had amassed $77.8 million worth of shares of Shutterfly. Moreover, Fine Capital Partners, P2 Capital Partners, and Park West Asset Management were also bullish on Shutterfly, Inc. (NASDAQ:SFLY).

Follow Shutterfly Inc (NASDAQ:SFLY)

Follow Shutterfly Inc (NASDAQ:SFLY)

Receive real-time insider trading and news alerts

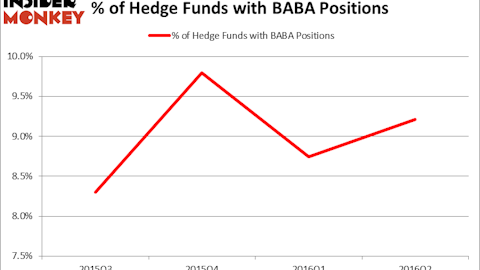

Eastbay Asset Management reported ownership of over 2.41 million Yelp Inc (NYSE:YELP) shares as of the end of the June quarter. This stake had an aggregate value of over $73.15 million as of June 30. The investment was one of the fund’s best, as the stock returned 37.4% during the third quarter. At the end of the second quarter, a total of 45 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 36% rise from the first quarter of 2016, as hedge funds timed their entry into the stock well. According to Insider Monkey’s hedge fund database, Eashwar Krishnan’s Tybourne Capital Management had the most valuable position in Yelp Inc (NYSE:YELP) among those funds, worth close to $186.7 million. The second largest stake is held by Greenlight Capital, led by David Einhorn, holding an $88 million position. Remaining professional money managers that are bullish include D E Shaw and Ken Griffin’s Citadel Investment Group.

Follow Yelp Inc (NYSE:YELP)

Follow Yelp Inc (NYSE:YELP)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

Eastbay Asset Management sold 20% of its position in Scientific Games Corp (NASDAQ:SGMS) in the second quarter, ending the period with about 3.28 million shares of the company, which had a net worth of over $30.15 million. The stock returned 22.6% during the third quarter, proving to be another huge boon for the fund. At the end of the second quarter, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, down by 13% from the previous quarter. Among these funds, Fine Capital Partners held the most valuable stake in Scientific Games Corp (NASDAQ:SGMS), which was worth $75.5 million at the end of the second quarter. Moreover, Nantahala Capital Management and PAR Capital Management were also bullish on Scientific Games Corp (NASDAQ:SGMS).

Follow Light & Wonder Inc. (NASDAQ:ASX:LNW)

Follow Light & Wonder Inc. (NASDAQ:ASX:LNW)

Receive real-time insider trading and news alerts

Eastbay Asset dumped 117,726 shares of online travel agent and booking company Expedia Inc (NASDAQ:EXPE) in the second quarter. This represents a 34% reduction in the fund’s position in the company as compared to a quarter earlier. Moving into the third quarter, Eastbay had a total of 222,609 shares of Expedia, having a total worth of over $23.66 million. The stock returned 10.1% during the third quarter.

The number of bullish hedge fund positions in Expedia inched up by 2 in recent months, with the stock being in 67 hedge funds’ portfolios at the end of June. The largest stake in Expedia Inc (NASDAQ:EXPE) among those funds was held by PAR Capital Management, which reported holding $695.9 million worth of stock as of the end of June. It was followed by Altimeter Capital Management with a $478.1 million position. Other investors bullish on the company included Tourbillon Capital Partners, Steadfast Capital Management, and JANA Partners.

Follow Expedia Group Inc. (NASDAQ:EXPE)

Follow Expedia Group Inc. (NASDAQ:EXPE)

Receive real-time insider trading and news alerts

Disclosure: None