Does Transocean Ltd (NYSE:RIG) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

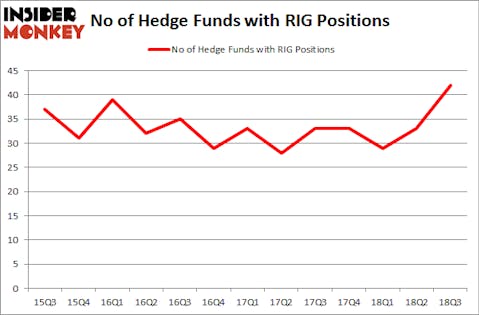

Transocean Ltd (NYSE:RIG) investors should pay attention to an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that RIG isn’t among the 30 most popular stocks among hedge funds.

At the moment there are numerous tools investors have at their disposal to grade their stock investments. Two of the less known tools are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the best hedge fund managers can outperform their index-focused peers by a significant amount (see the details here).

We’re going to check out the recent hedge fund action surrounding Transocean Ltd (NYSE:RIG).

What does the smart money think about Transocean Ltd (NYSE:RIG)?

Heading into the fourth quarter of 2018, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 27% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards RIG over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Transocean Ltd (NYSE:RIG) was held by Platinum Asset Management, which reported holding $202.2 million worth of stock at the end of September. It was followed by Orbis Investment Management with a $96.2 million position. Other investors bullish on the company included Renaissance Technologies, Citadel Investment Group, and Two Sigma Advisors.

Now, some big names have been driving this bullishness. Caxton Associates LP, managed by Bruce Kovner, assembled the biggest position in Transocean Ltd (NYSE:RIG). Caxton Associates LP had $36.9 million invested in the company at the end of the quarter. Robert Polak’s Anchor Bolt Capital also made a $22.7 million investment in the stock during the quarter. The other funds with brand new RIG positions are Mike Masters’s Masters Capital Management, Brian Ashford-Russell and Tim Woolley’s Polar Capital, and Alex Snow’s Lansdowne Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Transocean Ltd (NYSE:RIG) but similarly valued. We will take a look at Douglas Emmett, Inc. (NYSE:DEI), National Instruments Corporation (NASDAQ:NATI), Berry Global Group Inc (NYSE:BERY), and Sealed Air Corporation (NYSE:SEE). This group of stocks’ market valuations resemble RIG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DEI | 14 | 345417 | 3 |

| NATI | 24 | 500731 | 4 |

| BERY | 36 | 1964835 | 3 |

| SEE | 30 | 714746 | 5 |

| Average | 26 | 881432 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $881 million. That figure was $861 million in RIG’s case. Berry Global Group Inc (NYSE:BERY) is the most popular stock in this table. On the other hand Douglas Emmett, Inc. (NYSE:DEI) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Transocean Ltd (NYSE:RIG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.