There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze The Walt Disney Company (NYSE:DIS).

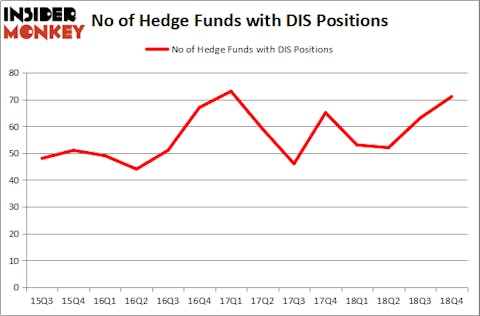

The Walt Disney Company (NYSE:DIS) was in 71 hedge funds’ portfolios at the end of December. DIS investors should pay attention to an increase in support from the world’s most elite money managers lately. There were 63 hedge funds in our database with DIS positions at the end of the previous quarter. Our calculations also showed that DIS is among the 30 most popular stocks among hedge funds, ranking 29th.

To most market participants, hedge funds are viewed as unimportant, old investment vehicles of years past. While there are over 8000 funds with their doors open at present, Our experts choose to focus on the bigwigs of this club, approximately 750 funds. These investment experts command most of all hedge funds’ total capital, and by keeping an eye on their highest performing stock picks, Insider Monkey has deciphered a few investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to take a peek at the key hedge fund action encompassing The Walt Disney Company (NYSE:DIS).

Hedge fund activity in The Walt Disney Company (NYSE:DIS)

Heading into the first quarter of 2019, a total of 71 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DIS over the last 14 quarters. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

The largest stake in The Walt Disney Company (NYSE:DIS) was held by Viking Global, which reported holding $371.2 million worth of stock at the end of September. It was followed by SRS Investment Management with a $351.9 million position. Other investors bullish on the company included D1 Capital Partners, Arrowstreet Capital, and Citadel Investment Group.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. D1 Capital Partners, managed by Daniel Sundheim, initiated the most valuable position in The Walt Disney Company (NYSE:DIS). D1 Capital Partners had $325.7 million invested in the company at the end of the quarter. Ryan Caldwell’s Chiron Investment Management also initiated a $45.4 million position during the quarter. The other funds with new positions in the stock are Rob Citrone’s Discovery Capital Management, Jeffrey Talpins’s Element Capital Management, and Michael Burry’s Scion Asset Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as The Walt Disney Company (NYSE:DIS) but similarly valued. These stocks are Oracle Corporation (NYSE:ORCL), PepsiCo, Inc. (NASDAQ:PEP), Comcast Corporation (NASDAQ:CMCSA), and Unilever plc (NYSE:UL). This group of stocks’ market values are similar to DIS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ORCL | 54 | 5762640 | 5 |

| PEP | 53 | 4043339 | 5 |

| CMCSA | 83 | 6159653 | -9 |

| UL | 13 | 212305 | -1 |

| Average | 50.75 | 4044484 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 50.75 hedge funds with bullish positions and the average amount invested in these stocks was $4044 million. That figure was $3408 million in DIS’s case. Comcast Corporation (NASDAQ:CMCSA) is the most popular stock in this table. On the other hand Unilever plc (NYSE:UL) is the least popular one with only 13 bullish hedge fund positions. The Walt Disney Company (NYSE:DIS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately Disney wasn’t in this group. Hedge funds that bet on Disney were disappointed as the stock returned 4.8% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.