Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Sodastream International Ltd (NASDAQ:SODA).

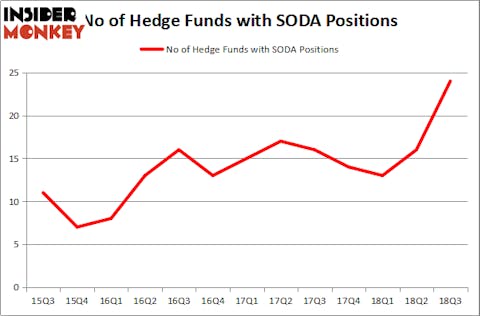

Sodastream International Ltd (NASDAQ:SODA) shareholders have witnessed an increase in hedge fund sentiment recently. Our calculations also showed that SODA isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a gander at the latest hedge fund action regarding Sodastream International Ltd (NASDAQ:SODA).

What have hedge funds been doing with Sodastream International Ltd (NASDAQ:SODA)?

Heading into the fourth quarter of 2018, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from the previous quarter. By comparison, 14 hedge funds held shares or bullish call options in SODA heading into this year. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Sodastream International Ltd (NASDAQ:SODA), with a stake worth $250.9 million reported as of the end of September. Trailing Renaissance Technologies was TIG Advisors, which amassed a stake valued at $121.9 million. Alpine Associates, Sand Grove Capital Partners, and Nantahala Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. TIG Advisors, managed by Carl Tiedemann and Michael Tiedemann, assembled the largest position in Sodastream International Ltd (NASDAQ:SODA). TIG Advisors had $121.9 million invested in the company at the end of the quarter. Robert Emil Zoellner’s Alpine Associates also made a $96.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Simon Davies’s Sand Grove Capital Partners, John Orrico’s Water Island Capital, and Paul Glazer’s Glazer Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Sodastream International Ltd (NASDAQ:SODA). We will take a look at Verint Systems Inc. (NASDAQ:VRNT), Array Biopharma Inc (NASDAQ:ARRY), Avanos Medical, Inc. (NYSE:AVNS), and Chegg Inc (NYSE:CHGG). This group of stocks’ market caps are similar to SODA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRNT | 18 | 319776 | 0 |

| ARRY | 30 | 816377 | -1 |

| AVNS | 17 | 114236 | 1 |

| CHGG | 21 | 368868 | 5 |

| Average | 21.5 | 404814 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $405 million. That figure was $828 million in SODA’s case. Array Biopharma Inc (NASDAQ:ARRY) is the most popular stock in this table. On the other hand Avanos Medical, Inc. (NYSE:AVNS) is the least popular one with only 17 bullish hedge fund positions. Sodastream International Ltd (NASDAQ:SODA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ARRY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.