Philip Rosenstrach‘s Pomelo Capital is a New York-based investment fund that started its operations in 2012 after spinning off from Barclays’s capital arbitrage arm. The fund’s equity portfolio was valued at $2.17 billion at the end of September, compared to $1.97 billion at the end of the second quarter. Pomelo Capital’s long positions in companies worth at least $1.0 billion generated a weighted average return of 18.5% during the third quarter and it was ranked the 35th best performing hedge fund in our database. Hedge funds on average underperform the market in bull markets because they are hedged. In our rankings, we consider only their long positions in companies worth at least $1.0 billion. This way when we can compare these returns to the returns of the S&P 500 ETFs – which are basically 100% long portfolios of large-cap stocks – it is a straightforward apples-to-apples comparison.

Our approach reveals interesting facts about hedge funds’ stock picking skills. For instance, there were 659 hedge funds in our database that had at least 5 non-microcap stocks in their 13F portfolio. These hedge funds’ long portfolio managed to deliver an average return of 8.3% during the third quarter whereas S&P 500 ETFs returned only 3.3%. We should note that hedge fund investors didn’t see average gains of 8.3% in their statements for two reasons. First, most hedge funds are hedged. This means they make 8% on the long side of their portfolio but they lose money on the short side of their portfolio. Their net returns also shrink after taking into account their cash or debt positions that don’t usually return much in this environment. Second, we don’t like this and believe that hedge fund fees are excessive, most hedge funds charge an arm and a leg for their services. Net of hedging and fees, it isn’t surprising to see that hedge fund investors experience lower returns than index fund investors. If investors don’t want the downside protection that comes with investing in hedge funds and want to beat the market returns, they can consider investing in the individual stock picks successful hedge fund managers.

That’s why we will be looking at the stock picks of Pomelo Capital in this article.

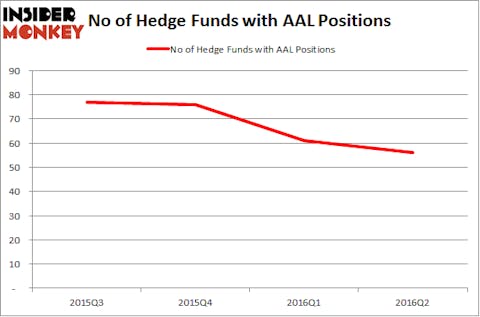

Pomelo Capital had initiated a stake in American Airlines Group Inc (NASDAQ:AAL) during the second quarter, buying 527,000 shares of the company worth over $14.92 million at the end of June. However, in the third quarter, amid a 29.7% advance registered by the company’s stock, the fund cut the position by 57% to 224,800 shares worth $8.23 million at the end of September. Overall, American Airlines Group Inc (NASDAQ:AAL) saw 56 funds from our database holding shares at the end of June, down from 61 funds a quarter earlier. Among these funds, Adage Capital Management held the most valuable stake in American Airlines Group Inc (NASDAQ:AAL), which was worth $178.2 million at the end of the second quarter. On the second spot was Stelliam Investment Management which amassed $174 million worth of shares. Moreover, Masters Capital Management, Cyrus Capital Partners, and Highland Capital Management were also bullish on American Airlines Group Inc (NASDAQ:AAL).

Follow American Airlines Group Inc. (NASDAQ:AAL)

Follow American Airlines Group Inc. (NASDAQ:AAL)

Receive real-time insider trading and news alerts

Pomelo had upped its stake in Valeant Pharmaceuticals Intl Inc (NYSE:VRX) by 68% in the second quarter, ending the period with a total of 724,900 shares of the company. In the third quarter, the stock appreciated by 21.9% and as the fund left the stake unchanged, its value went up to $17.80 million from $14.60 million. At the end of the second quarter, a total of 60 of the hedge funds tracked by Insider Monkey were long this stock, down by 15% from the previous quarter. Among these funds, Pershing Square held the most valuable stake in Valeant Pharmaceuticals Intl Inc (NYSE:VRX), which was worth $434.8 million at the end of the second quarter. On the second spot was Paulson & Co which amassed $384.1 million worth of shares. Moreover, ValueAct Capital, Okumus Fund Management, and Pentwater Capital Management were also bullish on Valeant Pharmaceuticals Intl Inc (NYSE:VRX).

Follow Bausch Health Companies Inc. (NYSE:BHC)

Follow Bausch Health Companies Inc. (NYSE:BHC)

Receive real-time insider trading and news alerts

Pomelo Capital had acquired 175,000 shares of United Continental Holdings Inc (NYSE:UAL) in the second quarter, and held 250,000 shares worth $10.26 million at the end of June. The stock returned 27.9% during the third quarter and Pomelo cut its exposure to the company by 47% to 131,000 shares worth $6.87 million during the same period. At the end of June, 57 funds from our database were bullish on this stock, a decline of 7% over the quarter. More specifically, PAR Capital Management was the largest shareholder of United Continental Holdings Inc (NYSE:UAL), with a stake worth $668.7 million reported as of the end of June. Trailing PAR Capital Management was Altimeter Capital Management, which amassed a stake valued at $472.3 million. AQR Capital Management, GMT Capital, and Citadel Investment Group also held valuable positions in the company.

Follow United Airlines Holdings Inc. (NASDAQ:UAL)

Follow United Airlines Holdings Inc. (NASDAQ:UAL)

Receive real-time insider trading and news alerts

On the other hand, Pomelo Capital acquired over 1.27 million shares of Seadrill Ltd (NYSE:SDRL) in the second quarter and further increased the stake by 113,858 shares in the third quarter, holding around 1.50 million shares valued at $3.55 million at the end of September. Meanwhile, the stock slid by 26.9% during the third quarter. During the second quarter, the number of funds from our database long Seadrill went down by 23% to 17. Robert Henry Lynch’s Aristeia Capital had the most valuable position in Seadrill Ltd (NYSE:SDRL), worth close to $17.1 million at the end of June. On Aristeia Capital’s heels was Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, with a $16 million position. Other members of the smart money that held long positions contained Joel Greenblatt’s Gotham Asset Management, Philippe Laffont’s Coatue Management and Himanshu H. Shah’s Shah Capital Management.

Follow Seadrill Ltd (NYSE:SDRL)

Follow Seadrill Ltd (NYSE:SDRL)

Receive real-time insider trading and news alerts

Disclosure: none