Does Marathon Oil Corporation (NYSE:MRO) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

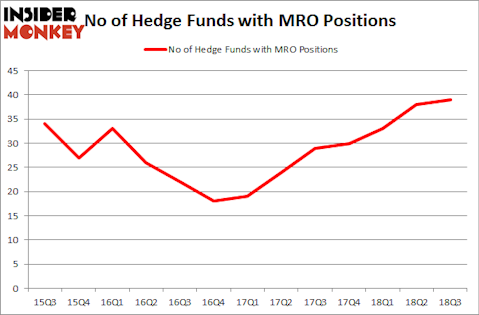

Is Marathon Oil Corporation (NYSE:MRO) undervalued? Money managers are getting more optimistic. The number of long hedge fund positions increased by 1 recently. Our calculations also showed that MRO isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of metrics shareholders use to appraise stocks. A pair of the best metrics are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can beat the market by a very impressive amount (see the details here).

We’re going to take a glance at the recent hedge fund action encompassing Marathon Oil Corporation (NYSE:MRO).

How are hedge funds trading Marathon Oil Corporation (NYSE:MRO)?

Heading into the fourth quarter of 2018, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards MRO over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Ken Griffin’s Citadel Investment Group has the number one position in Marathon Oil Corporation (NYSE:MRO), worth close to $411.1 million, amounting to 0.2% of its total 13F portfolio. On Citadel Investment Group’s heels is Millennium Management, managed by Israel Englander, which holds a $307.2 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism contain Cliff Asness’s AQR Capital Management, Dmitry Balyasny’s Balyasny Asset Management and Anand Parekh’s Alyeska Investment Group.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Senator Investment Group, managed by Doug Silverman and Alexander Klabin, initiated the biggest position in Marathon Oil Corporation (NYSE:MRO). Senator Investment Group had $46.6 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also made a $25 million investment in the stock during the quarter. The following funds were also among the new MRO investors: Malcolm Fairbairn’s Ascend Capital, Guy Shahar’s DSAM Partners, and Benjamin A. Smith’s Laurion Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Marathon Oil Corporation (NYSE:MRO). These stocks are Verisk Analytics, Inc. (NASDAQ:VRSK), DTE Energy Company (NYSE:DTE), Tenaris S.A. (NYSE:TS), and Regions Financial Corporation (NYSE:RF). This group of stocks’ market valuations match MRO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRSK | 23 | 902227 | -5 |

| DTE | 25 | 706241 | 5 |

| TS | 18 | 686842 | -2 |

| RF | 31 | 951749 | -10 |

| Average | 24.25 | 811765 | -3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $812 million. That figure was $1.58 billion in MRO’s case. Regions Financial Corporation (NYSE:RF) is the most popular stock in this table. On the other hand Tenaris S.A. (NYSE:TS) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Marathon Oil Corporation (NYSE:MRO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.