Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Philip Morris International Inc. (NYSE:PM).

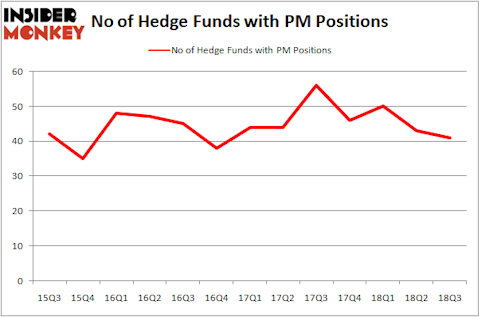

Philip Morris International Inc. (NYSE:PM) was in 41 hedge funds’ portfolios at the end of the third quarter of 2018. PM investors should pay attention to a decrease in hedge fund interest in recent months. There were 43 hedge funds in our database with PM holdings at the end of the previous quarter. Our calculations also showed that PM isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most traders, hedge funds are assumed to be worthless, old investment tools of the past. While there are greater than 8000 funds with their doors open today, Our researchers hone in on the crème de la crème of this club, about 700 funds. Most estimates calculate that this group of people have their hands on bulk of the hedge fund industry’s total asset base, and by tracking their best equity investments, Insider Monkey has unearthed several investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a glance at the latest hedge fund action regarding Philip Morris International Inc. (NYSE:PM).

Hedge fund activity in Philip Morris International Inc. (NYSE:PM)

At Q3’s end, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -5% from the second quarter of 2018. By comparison, 46 hedge funds held shares or bullish call options in PM heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Gardner Russo & Gardner, managed by Tom Russo, holds the number one position in Philip Morris International Inc. (NYSE:PM). Gardner Russo & Gardner has a $840 million position in the stock, comprising 6.1% of its 13F portfolio. The second most bullish fund manager is Cedar Rock Capital, managed by Andy Brown, which holds a $765.4 million position; the fund has 18.8% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish encompass Ric Dillon’s Diamond Hill Capital, John W. Rogers’s Ariel Investments and Phill Gross and Robert Atchinson’s Adage Capital Management.

Due to the fact that Philip Morris International Inc. (NYSE:PM) has experienced a decline in interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of fund managers that slashed their entire stakes by the end of the third quarter. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP dumped the biggest stake of all the hedgies monitored by Insider Monkey, valued at an estimated $54.1 million in stock, and Richard Gerson and Navroz D. Udwadia’s Falcon Edge Capital was right behind this move, as the fund cut about $27 million worth. These moves are interesting, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Philip Morris International Inc. (NYSE:PM) but similarly valued. These stocks are 3M Company (NYSE:MMM), Honeywell International Inc. (NYSE:HON), China Petroleum & Chemical Corp (NYSE:SNP), and Union Pacific Corporation (NYSE:UNP). This group of stocks’ market caps are similar to PM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MMM | 34 | 355750 | 1 |

| HON | 47 | 2452575 | -2 |

| SNP | 13 | 284383 | -1 |

| UNP | 53 | 4921725 | 4 |

| Average | 36.75 | 2004 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.75 hedge funds with bullish positions and the average amount invested in these stocks was $2004 million. That figure was $2897 million in PM’s case. Union Pacific Corporation (NYSE:UNP) is the most popular stock in this table. On the other hand China Petroleum & Chemical Corp (NYSE:SNP) is the least popular one with only 13 bullish hedge fund positions. Philip Morris International Inc. (NYSE:PM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard UNP might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.