The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 873 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of June 30th, 2021. What do these smart investors think about Adtalem Global Education Inc. (NYSE:ATGE)?

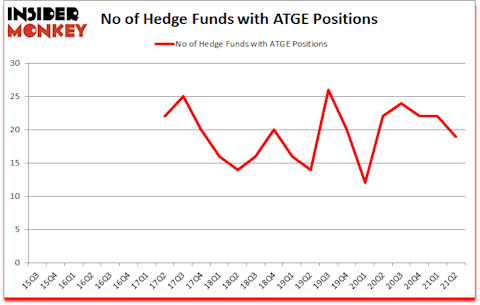

Adtalem Global Education Inc. (NYSE:ATGE) investors should be aware of a decrease in support from the world’s most elite money managers lately. Adtalem Global Education Inc. (NYSE:ATGE) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 26. There were 22 hedge funds in our database with ATGE holdings at the end of March. Our calculations also showed that ATGE isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Keeping this in mind let’s analyze the new hedge fund action regarding Adtalem Global Education Inc. (NYSE:ATGE).

Do Hedge Funds Think ATGE Is A Good Stock To Buy Now?

Heading into the third quarter of 2021, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the first quarter of 2020. On the other hand, there were a total of 22 hedge funds with a bullish position in ATGE a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, John W. Rogers’s Ariel Investments has the most valuable position in Adtalem Global Education Inc. (NYSE:ATGE), worth close to $119.8 million, comprising 1.1% of its total 13F portfolio. The second largest stake is held by Madison Avenue Partners, managed by Eli Samaha, which holds a $54.3 million position; 16.2% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish comprise Cliff Asness’s AQR Capital Management, Vadim Rubinchik’s Brightlight Capital and Arnaud Ajdler’s Engine Capital. In terms of the portfolio weights assigned to each position Madison Avenue Partners allocated the biggest weight to Adtalem Global Education Inc. (NYSE:ATGE), around 16.21% of its 13F portfolio. Brightlight Capital is also relatively very bullish on the stock, dishing out 10.71 percent of its 13F equity portfolio to ATGE.

Judging by the fact that Adtalem Global Education Inc. (NYSE:ATGE) has witnessed bearish sentiment from the smart money, logic holds that there exists a select few funds that decided to sell off their entire stakes heading into Q3. It’s worth mentioning that David Brown’s Hawk Ridge Management said goodbye to the biggest investment of the “upper crust” of funds tracked by Insider Monkey, comprising close to $10.5 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $6.5 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Adtalem Global Education Inc. (NYSE:ATGE). We will take a look at Tattooed Chef, Inc. (NASDAQ:TTCF), Super Micro Computer, Inc. (NASDAQ:SMCI), Viant Technology Inc. (NASDAQ:DSP), Hope Bancorp, Inc. (NASDAQ:HOPE), Veritex Holdings Inc (NASDAQ:VBTX), Applied Molecular Transport Inc. (NASDAQ:AMTI), and Avanos Medical, Inc. (NYSE:AVNS). This group of stocks’ market valuations resemble ATGE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTCF | 7 | 38898 | -3 |

| SMCI | 20 | 373688 | -1 |

| DSP | 6 | 12575 | -8 |

| HOPE | 16 | 78597 | 3 |

| VBTX | 9 | 38993 | 3 |

| AMTI | 3 | 3167 | 0 |

| AVNS | 16 | 218001 | 3 |

| Average | 11 | 109131 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $109 million. That figure was $295 million in ATGE’s case. Super Micro Computer, Inc. (NASDAQ:SMCI) is the most popular stock in this table. On the other hand Applied Molecular Transport Inc. (NASDAQ:AMTI) is the least popular one with only 3 bullish hedge fund positions. Adtalem Global Education Inc. (NYSE:ATGE) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ATGE is 71. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and beat the market again by 1.6 percentage points. Unfortunately ATGE wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ATGE were disappointed as the stock returned 3.3% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Adtalem Global Education Inc. (NYSE:ATGE)

Follow Adtalem Global Education Inc. (NYSE:ATGE)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 States with the Cheapest Health Insurance

- Billionaire Andreas Halvorsen’s Top Stock Picks

- 10 Best Cheap Stocks to Buy According to Michael Burry

Disclosure: None. This article was originally published at Insider Monkey.