The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) based on those filings.

Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 2 hedge funds’ portfolios at the end of September. At the end of this article we will also compare RMCF to other stocks including Perma-Fix Environmental Services, Inc. (NASDAQ:PESI), Oramed Pharmaceuticals Inc. (NASDAQ:ORMP), and Davids Tea Inc (NASDAQ:DTEA) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Jim Simons of RENAISSANCE TECHNOLOGIES

Let’s take a look at the fresh hedge fund action regarding Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF).

What have hedge funds been doing with Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF)?

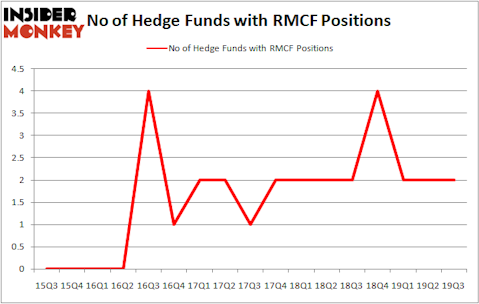

At the end of the third quarter, a total of 2 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in RMCF over the last 17 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies founded by Jim Simons has the most valuable position in Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF), worth close to $4.4 million, comprising less than 0.1%% of its total 13F portfolio. On Renaissance Technologies’s heels is Fondren Management, led by Bradley Louis Radoff, holding a $2.6 million position; 2.2% of its 13F portfolio is allocated to the company.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks similar to Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF). We will take a look at Perma-Fix Environmental Services, Inc. (NASDAQ:PESI), Oramed Pharmaceuticals Inc. (NASDAQ:ORMP), Davids Tea Inc (NASDAQ:DTEA), and AquaBounty Technologies, Inc. (NASDAQ:AQB). This group of stocks’ market valuations are similar to RMCF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PESI | 2 | 1867 | 0 |

| ORMP | 5 | 1388 | 2 |

| DTEA | 1 | 52 | 0 |

| AQB | 2 | 4823 | 0 |

| Average | 2.5 | 2033 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 2.5 hedge funds with bullish positions and the average amount invested in these stocks was $2 million. That figure was $7 million in RMCF’s case. Oramed Pharmaceuticals Inc. (NASDAQ:ORMP) is the most popular stock in this table. On the other hand Davids Tea Inc (NASDAQ:DTEA) is the least popular one with only 1 bullish hedge fund positions. Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately RMCF wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); RMCF investors were disappointed as the stock returned -6.2% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.