Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of Paylocity Holding Corp (NASDAQ:PCTY) based on that data.

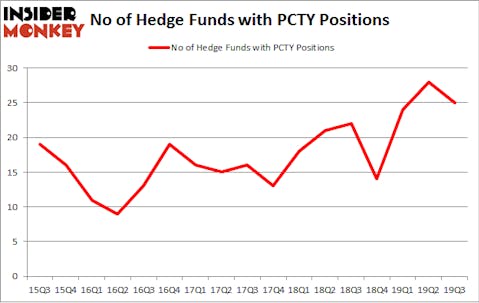

Paylocity Holding Corp (NASDAQ:PCTY) was in 25 hedge funds’ portfolios at the end of September. PCTY has experienced a decrease in activity from the world’s largest hedge funds of late. There were 28 hedge funds in our database with PCTY holdings at the end of the previous quarter. Our calculations also showed that PCTY isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

At the moment there are many signals shareholders can use to evaluate publicly traded companies. Some of the less known signals are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top money managers can outpace the S&P 500 by a healthy amount (see the details here).

John Overdeck of Two Sigma Advisors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind we’re going to take a gander at the new hedge fund action encompassing Paylocity Holding Corp (NASDAQ:PCTY).

How have hedgies been trading Paylocity Holding Corp (NASDAQ:PCTY)?

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -11% from the second quarter of 2019. On the other hand, there were a total of 22 hedge funds with a bullish position in PCTY a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Alkeon Capital Management, managed by Panayotis Takis Sparaggis, holds the number one position in Paylocity Holding Corp (NASDAQ:PCTY). Alkeon Capital Management has a $78.5 million position in the stock, comprising 0.3% of its 13F portfolio. The second most bullish fund manager is Echo Street Capital Management, led by Greg Poole, holding a $48.3 million position; 0.8% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism contain John Overdeck and David Siegel’s Two Sigma Advisors, Renaissance Technologies and David E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Algert Coldiron Investors allocated the biggest weight to Paylocity Holding Corp (NASDAQ:PCTY), around 0.84% of its 13F portfolio. Echo Street Capital Management is also relatively very bullish on the stock, dishing out 0.82 percent of its 13F equity portfolio to PCTY.

Since Paylocity Holding Corp (NASDAQ:PCTY) has witnessed a decline in interest from the smart money, we can see that there were a few fund managers who were dropping their entire stakes last quarter. At the top of the heap, Donald Sussman’s Paloma Partners dropped the biggest stake of all the hedgies tracked by Insider Monkey, valued at close to $6.3 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also said goodbye to its stock, about $1.7 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 3 funds last quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Paylocity Holding Corp (NASDAQ:PCTY) but similarly valued. These stocks are Hudson Pacific Properties Inc (NYSE:HPP), HUYA Inc. (NYSE:HUYA), Calgon Carbon Corporation (NYSE:CCC), and Companhia Brasileira de Distrib. (NYSE:CBD). All of these stocks’ market caps resemble PCTY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HPP | 24 | 260095 | 7 |

| HUYA | 21 | 361903 | -1 |

| CCC | 38 | 686023 | 17 |

| CBD | 11 | 44794 | 0 |

| Average | 23.5 | 338204 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $338 million. That figure was $314 million in PCTY’s case. Calgon Carbon Corporation (NYSE:CCC) is the most popular stock in this table. On the other hand Companhia Brasileira de Distrib. (NYSE:CBD) is the least popular one with only 11 bullish hedge fund positions. Paylocity Holding Corp (NASDAQ:PCTY) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on PCTY as the stock returned 100.7% in 2019 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.