Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Paylocity Holding Corp (NASDAQ:PCTY) investors should be aware of an increase in enthusiasm from smart money recently. Our calculations also showed that pcty isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are tons of gauges stock market investors employ to grade publicly traded companies. A couple of the less known gauges are hedge fund and insider trading moves. We have shown that, historically, those who follow the best picks of the top money managers can trounce the broader indices by a healthy amount (see the details here).

Noam Gottesman, GLG Partners

We’re going to take a glance at the recent hedge fund action encompassing Paylocity Holding Corp (NASDAQ:PCTY).

How are hedge funds trading Paylocity Holding Corp (NASDAQ:PCTY)?

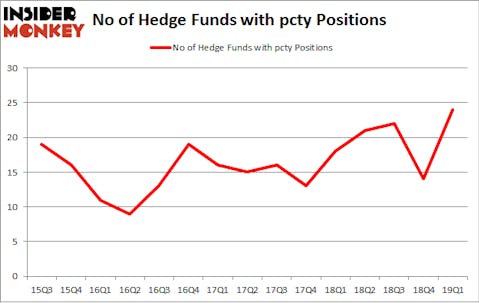

Heading into the second quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, a change of 71% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PCTY over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Echo Street Capital Management, managed by Greg Poole, holds the biggest position in Paylocity Holding Corp (NASDAQ:PCTY). Echo Street Capital Management has a $31.1 million position in the stock, comprising 0.6% of its 13F portfolio. Coming in second is D E Shaw, managed by D. E. Shaw, which holds a $20.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers that are bullish contain John Overdeck and David Siegel’s Two Sigma Advisors, Israel Englander’s Millennium Management and Noam Gottesman’s GLG Partners.

With a general bullishness amongst the heavyweights, some big names were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Paylocity Holding Corp (NASDAQ:PCTY). Arrowstreet Capital had $8.5 million invested in the company at the end of the quarter. Phill Gross and Robert Atchinson’s Adage Capital Management also initiated a $4 million position during the quarter. The following funds were also among the new PCTY investors: Panayotis Takis Sparaggis’s Alkeon Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Paylocity Holding Corp (NASDAQ:PCTY) but similarly valued. We will take a look at Casey’s General Stores, Inc. (NASDAQ:CASY), BWX Technologies Inc (NYSE:BWXT), Avnet, Inc. (NYSE:AVT), and Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC). All of these stocks’ market caps resemble PCTY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CASY | 18 | 51288 | 0 |

| BWXT | 18 | 107854 | -1 |

| AVT | 17 | 586463 | -7 |

| TKC | 7 | 8792 | -2 |

| Average | 15 | 188599 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $189 million. That figure was $149 million in PCTY’s case. Casey’s General Stores, Inc. (NASDAQ:CASY) is the most popular stock in this table. On the other hand Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Paylocity Holding Corp (NASDAQ:PCTY) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on PCTY as the stock returned 13% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.