Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the third quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 4 percentage points through September 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Old National Bancorp (NYSE:ONB) has seen an increase in support from the world’s most elite money managers recently. Our calculations also showed that ONB isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are numerous signals market participants employ to appraise publicly traded companies. Two of the most underrated signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can outperform their index-focused peers by a healthy amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the latest hedge fund action regarding Old National Bancorp (NYSE:ONB).

What does smart money think about Old National Bancorp (NYSE:ONB)?

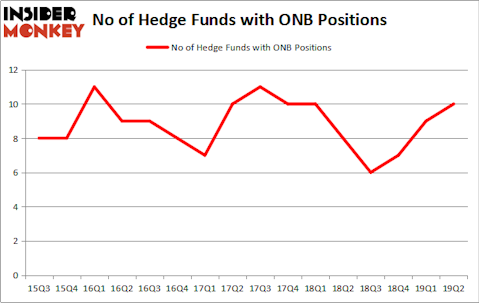

Heading into the third quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 11% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ONB over the last 16 quarters. With hedgies’ sentiment swirling, there exists a few notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, PEAK6 Capital Management held the most valuable stake in Old National Bancorp (NYSE:ONB), which was worth $20 million at the end of the second quarter. On the second spot was Citadel Investment Group which amassed $17.1 million worth of shares. Moreover, Basswood Capital, Citadel Investment Group, and Private Capital Management were also bullish on Old National Bancorp (NYSE:ONB), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, initiated the largest call position in Old National Bancorp (NYSE:ONB). Citadel Investment Group had $17.1 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $1.4 million investment in the stock during the quarter. The other funds with brand new ONB positions are Dmitry Balyasny’s Balyasny Asset Management and Steve Cohen’s Point72 Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Old National Bancorp (NYSE:ONB). These stocks are Hilton Grand Vacations Inc. (NYSE:HGV), Mimecast Limited (NASDAQ:MIME), Hutchison China MediTech Limited (NASDAQ:HCM), and Cathay General Bancorp (NASDAQ:CATY). This group of stocks’ market values match ONB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HGV | 37 | 959432 | 0 |

| MIME | 26 | 846004 | -9 |

| HCM | 23 | 103651 | 17 |

| CATY | 12 | 38123 | -2 |

| Average | 24.5 | 486803 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $487 million. That figure was $20 million in ONB’s case. Hilton Grand Vacations Inc. (NYSE:HGV) is the most popular stock in this table. On the other hand Cathay General Bancorp (NASDAQ:CATY) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Old National Bancorp (NYSE:ONB) is even less popular than CATY. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on ONB, though not to the same extent, as the stock returned 4.5% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.