Hedge funds run by legendary names like Nelson Peltz and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant out-performance. These stocks have been on a tear since the end of June, outperforming large-cap index funds by more than 10 percentage points. That’s why we pay special attention to hedge fund activity in these stocks.

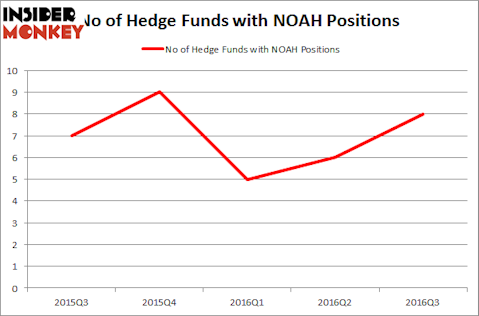

Is Noah Holdings Limited (ADR) (NYSE:NOAH) the right pick for your portfolio? Money managers are categorically getting more optimistic. The number of long hedge fund positions improved by 2 lately. There were 8 hedge funds in our database with NOAH positions at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Children’s Place Retail Stores, Inc. (NASDAQ:PLCE), American States Water Co (NYSE:AWR), and Innospec Inc. (NASDAQ:IOSP) to gather more data points.

Follow Noah Holdings Ltd (NYSE:NOAH)

Follow Noah Holdings Ltd (NYSE:NOAH)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

oneinchpunch/Shutterstock.com

Hedge fund activity in Noah Holdings Limited (ADR) (NYSE:NOAH)

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 33% from one quarter earlier. By comparison, 9 hedge funds held shares or bullish call options in NOAH heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Run Ye, Junji Takegami and Hoyon Hwang’s Tiger Pacific Capital has the most valuable position in Noah Holdings Limited (ADR) (NYSE:NOAH), worth close to $37.9 million, accounting for 31.5% of its total 13F portfolio. The second most bullish fund manager is Yi Xin of Ariose Capital, with a $7 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism include Fang Zheng’s Keywise Capital Management, Matthew Hulsizer’s PEAK6 Capital Management and Warren Lammert’s Granite Point Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, key hedge funds have jumped into Noah Holdings Limited (ADR) (NYSE:NOAH) headfirst. Granite Point Capital, led by Warren Lammert, created the most outsized position in Noah Holdings Limited (ADR) (NYSE:NOAH). Granite Point Capital had $0.4 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also made a $0.4 million investment in the stock during the quarter. The following funds were also among the new NOAH investors: Cliff Asness’ AQR Capital Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Noah Holdings Limited (ADR) (NYSE:NOAH) but similarly valued. We will take a look at Children’s Place Retail Stores, Inc. (NASDAQ:PLCE), American States Water Co (NYSE:AWR), Innospec Inc. (NASDAQ:IOSP), and Dynegy Inc. (NYSE:DYN). All of these stocks’ market caps are similar to NOAH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLCE | 22 | 216244 | -7 |

| AWR | 8 | 42205 | 0 |

| IOSP | 18 | 141063 | 0 |

| DYN | 36 | 760238 | -7 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $290 million. That figure was $53 million in NOAH’s case. Dynegy Inc. (NYSE:DYN) is the most popular stock in this table. On the other hand American States Water Co (NYSE:AWR) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Noah Holdings Limited (ADR) (NYSE:NOAH) is even less popular than AWR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

High Profit Margin Businesses To Start In India

Best Part-Time Jobs For Teens

Most Affordable Physical Therapy Schools

Disclosure: None