Hedge funds don’t get the respect they used to get. Nowadays investors prefer passive funds over actively managed funds. One thing they don’t realize is that 100% of the passive funds didn’t see the coronavirus recession coming, but a lot of hedge funds did. Even we published an article near the end of February and predicted a US recession. Think about all the losses you could have avoided if you sold your shares in February and bought them back at the end of March.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind let’s see whether Meta Financial Group Inc. (NASDAQ:CASH) represents a good buying opportunity at the moment. Let’s quickly check the hedge fund interest towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on satellite photos and other research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail inconceivably on some occasions, but net net their stock picks have been generating superior risk-adjusted returns on average over the years.

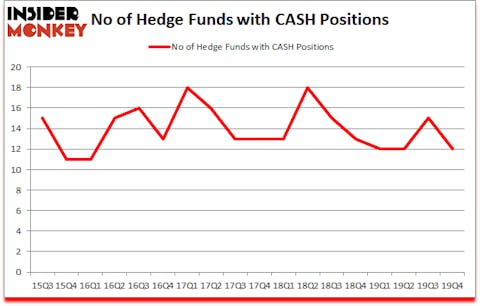

Is Meta Financial Group Inc. (NASDAQ:CASH) a safe investment today? Money managers are in a pessimistic mood. The number of long hedge fund bets shrunk by 3 lately. Our calculations also showed that CASH isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

We leave no stone unturned when looking for the next great investment idea. For example, this investor can predict short term winners following earnings announcements with 77% accuracy, so we check out his stock picks. A former hedge fund manager is pitching the “next Amazon” in this video; again we are listening. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to check out the fresh hedge fund action encompassing Meta Financial Group Inc. (NASDAQ:CASH).

What does smart money think about Meta Financial Group Inc. (NASDAQ:CASH)?

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from the third quarter of 2019. By comparison, 13 hedge funds held shares or bullish call options in CASH a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Nantahala Capital Management, managed by Wilmot B. Harkey and Daniel Mack, holds the largest position in Meta Financial Group Inc. (NASDAQ:CASH). Nantahala Capital Management has a $65.7 million position in the stock, comprising 2% of its 13F portfolio. The second largest stake is held by Steamboat Capital Partners, led by Parsa Kiai, holding a $26.7 million position; the fund has 7.5% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions contain Tom Brown’s Second Curve Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Richard Driehaus’s Driehaus Capital. In terms of the portfolio weights assigned to each position Second Curve Capital allocated the biggest weight to Meta Financial Group Inc. (NASDAQ:CASH), around 9.08% of its 13F portfolio. Steamboat Capital Partners is also relatively very bullish on the stock, dishing out 7.55 percent of its 13F equity portfolio to CASH.

Due to the fact that Meta Financial Group Inc. (NASDAQ:CASH) has witnessed declining sentiment from the smart money, we can see that there was a specific group of funds that elected to cut their entire stakes by the end of the third quarter. At the top of the heap, Renaissance Technologies cut the biggest position of the “upper crust” of funds watched by Insider Monkey, comprising close to $3.5 million in stock. David Harding’s fund, Winton Capital Management, also cut its stock, about $0.4 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Meta Financial Group Inc. (NASDAQ:CASH). We will take a look at Veracyte Inc (NASDAQ:VCYT), Tanger Factory Outlet Centers Inc. (NYSE:SKT), Tompkins Financial Corporation (NYSE:TMP), and Hawaiian Holdings, Inc. (NASDAQ:HA). This group of stocks’ market caps are similar to CASH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VCYT | 14 | 73949 | -4 |

| SKT | 14 | 52707 | -6 |

| TMP | 6 | 20385 | 0 |

| HA | 15 | 96265 | 3 |

| Average | 12.25 | 60827 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $61 million. That figure was $152 million in CASH’s case. Hawaiian Holdings, Inc. (NASDAQ:HA) is the most popular stock in this table. On the other hand Tompkins Financial Corporation (NYSE:TMP) is the least popular one with only 6 bullish hedge fund positions. Meta Financial Group Inc. (NASDAQ:CASH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately CASH wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); CASH investors were disappointed as the stock returned -52.8% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.