We at Insider Monkey have gone over 752 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. In this article, we look at what those funds think of Materialise NV (NASDAQ:MTLS) based on that data.

Hedge fund interest in Materialise NV (NASDAQ:MTLS) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare MTLS to other stocks including Re/Max Holdings Inc (NYSE:RMAX), Livent Corporation (NYSE:LTHM), and National Western Life Group, Inc. (NASDAQ:NWLI) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are viewed as worthless, outdated financial tools of yesteryear. While there are over 8000 funds trading at the moment, Our experts hone in on the masters of this club, about 750 funds. These investment experts administer the majority of the smart money’s total asset base, and by tailing their first-class investments, Insider Monkey has found many investment strategies that have historically outrun the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Let’s analyze the fresh hedge fund action surrounding Materialise NV (NASDAQ:MTLS).

Hedge fund activity in Materialise NV (NASDAQ:MTLS)

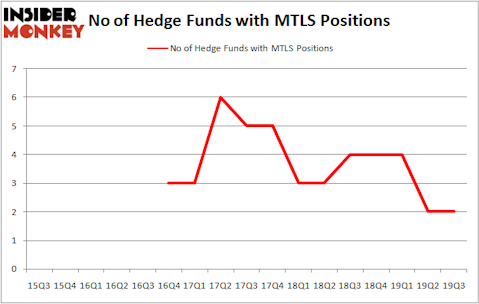

At the end of the third quarter, a total of 2 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MTLS over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Materialise NV (NASDAQ:MTLS) was held by Royce & Associates, which reported holding $5 million worth of stock at the end of September. It was followed by Renaissance Technologies with a $4.4 million position.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Materialise NV (NASDAQ:MTLS) but similarly valued. We will take a look at Re/Max Holdings Inc (NYSE:RMAX), Livent Corporation (NYSE:LTHM), National Western Life Group, Inc. (NASDAQ:NWLI), and Zymeworks Inc. (NYSE:ZYME). This group of stocks’ market values are closest to MTLS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RMAX | 9 | 91557 | -1 |

| LTHM | 20 | 123690 | -1 |

| NWLI | 9 | 16662 | 1 |

| ZYME | 16 | 347944 | 2 |

| Average | 13.5 | 144963 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $145 million. That figure was $9 million in MTLS’s case. Livent Corporation (NYSE:LTHM) is the most popular stock in this table. On the other hand Re/Max Holdings Inc (NYSE:RMAX) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Materialise NV (NASDAQ:MTLS) is even less popular than RMAX. Hedge funds dodged a bullet by taking a bearish stance towards MTLS. Our calculations showed that the top 20 most popular hedge fund stocks returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately MTLS wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); MTLS investors were disappointed as the stock returned -5.8% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.