Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the 12-month period ending October 30. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 30 stock picks outperformed the S&P 500 Index by 4 percentage points through the middle of November. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

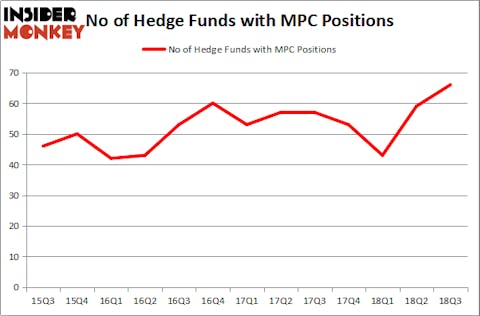

Is Marathon Petroleum Corp (NYSE:MPC) ready to rally soon? Investors who are in the know are becoming hopeful. The number of bullish hedge fund bets advanced by 7 in recent months. While our calculations showed that MPC isn’t among the 30 most popular stocks among hedge funds, billionaires are much more bullish on the energy company, as it landed on the list of 30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index.

In the financial world, there are tons of metrics stock traders put to use to assess publicly traded companies. A duo of the most innovative metrics are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the best money managers can outperform their index-focused peers by a significant margin (see the details here).

What have hedge funds been doing with Marathon Petroleum Corp (NYSE:MPC)?

Heading into the fourth quarter of 2018, a total of 66 of the hedge funds tracked by Insider Monkey were bullish on this stock, a jump of 12% from the previous quarter. On the other hand, there were a total of 53 hedge funds with a bullish position in MPC at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Marathon Petroleum Corp (NYSE:MPC) was held by Viking Global, which reported holding $571.9 million worth of stock at the end of September. It was followed by Point State Capital with a $397 million position. Other investors bullish on the company included D E Shaw, Iridian Asset Management, and Millennium Management.

Consequently, key hedge funds were breaking ground themselves. DSAM Partners, managed by Guy Shahar, assembled the most valuable position in Marathon Petroleum Corp (NYSE:MPC). DSAM Partners had $36 million invested in the company at the end of the quarter. Joe DiMenna’s ZWEIG DIMENNA PARTNERS also made a $17.8 million investment in the stock during the quarter. The following funds were also among the new MPC investors: Ken Heebner’s Capital Growth Management, Till Bechtolsheimer’s Arosa Capital Management, and Sara Nainzadeh’s Centenus Global Management.

Let’s now review hedge fund activity in other stocks similar to Marathon Petroleum Corp (NYSE:MPC). We will take a look at Fidelity National Information Services Inc. (NYSE:FIS), Southwest Airlines Co. (NYSE:LUV), China Unicom (Hong Kong) Limited (NYSE:CHU), and Halliburton Company (NYSE:HAL). This group of stocks’ market valuations resemble MPC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIS | 36 | 1952578 | 4 |

| LUV | 41 | 5209151 | 5 |

| CHU | 6 | 53534 | -3 |

| HAL | 39 | 789589 | -5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $2.00 billion. That figure was $4.80 billion in MPC’s case. Southwest Airlines Co. (NYSE:LUV) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (NYSE:CHU) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Marathon Petroleum Corp (NYSE:MPC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.