While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Marathon Petroleum Corp (NYSE:MPC) and see how the stock performed in comparison to hedge funds’ consensus picks.

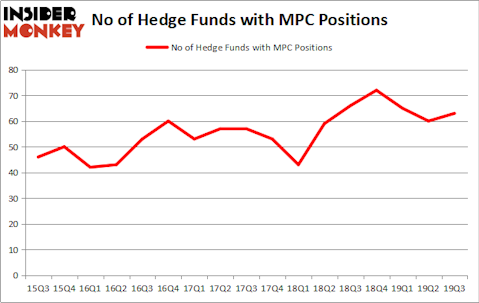

Marathon Petroleum Corp (NYSE:MPC) was in 63 hedge funds’ portfolios at the end of September. MPC investors should pay attention to an increase in enthusiasm from smart money of late. There were 60 hedge funds in our database with MPC positions at the end of the previous quarter. Our calculations also showed that MPC isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Andy Redleaf of Whitebox Advisors

We leave no stone unturned when looking for the next great investment idea. For example one of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. Keeping this in mind we’re going to take a peek at the latest hedge fund action encompassing Marathon Petroleum Corp (NYSE:MPC).

How are hedge funds trading Marathon Petroleum Corp (NYSE:MPC)?

Heading into the fourth quarter of 2019, a total of 63 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the second quarter of 2019. On the other hand, there were a total of 66 hedge funds with a bullish position in MPC a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Elliott Management, managed by Paul Singer, holds the most valuable position in Marathon Petroleum Corp (NYSE:MPC). Elliott Management has a $522.3 million position in the stock, comprising 4.4% of its 13F portfolio. The second largest stake is held by Robert Pitts of Steadfast Capital Management, with a $352.3 million position; 4.8% of its 13F portfolio is allocated to the stock. Other members of the smart money that hold long positions contain David Cohen and Harold Levy’s Iridian Asset Management, Israel Englander’s Millennium Management and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Swift Run Capital Management allocated the biggest weight to Marathon Petroleum Corp (NYSE:MPC), around 10.15% of its 13F portfolio. Steadfast Capital Management is also relatively very bullish on the stock, setting aside 4.8 percent of its 13F equity portfolio to MPC.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Whitebox Advisors, managed by Andy Redleaf, initiated the most valuable position in Marathon Petroleum Corp (NYSE:MPC). Whitebox Advisors had $47.4 million invested in the company at the end of the quarter. Mark Kingdon’s Kingdon Capital also made a $30.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Stephen J. Errico’s Locust Wood Capital Advisers, Todd J. Kantor’s Encompass Capital Advisors, and Joel Greenblatt’s Gotham Asset Management.

Let’s now review hedge fund activity in other stocks similar to Marathon Petroleum Corp (NYSE:MPC). These stocks are Occidental Petroleum Corporation (NYSE:OXY), Ross Stores, Inc. (NASDAQ:ROST), Constellation Brands, Inc. (NYSE:STZ), and Telefonica S.A. (NYSE:TEF). This group of stocks’ market valuations are closest to MPC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OXY | 57 | 2774136 | 15 |

| ROST | 39 | 1067484 | 7 |

| STZ | 41 | 1671280 | 3 |

| TEF | 5 | 34830 | -2 |

| Average | 35.5 | 1386933 | 5.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.5 hedge funds with bullish positions and the average amount invested in these stocks was $1387 million. That figure was $2859 million in MPC’s case. Occidental Petroleum Corporation (NYSE:OXY) is the most popular stock in this table. On the other hand Telefonica S.A. (NYSE:TEF) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Marathon Petroleum Corp (NYSE:MPC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately MPC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MPC were disappointed as the stock returned 6.8% so far in 2019 (through 12/23) and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks already outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.