In a recent interview with CNBC, Mario Gabelli, a successful investment manager, has talked about two stocks that would double in the near future. One was Gencorp, with its huge hidden real estate value. The other was Legg Mason, Inc. (NYSE:LM), a global asset management company. In this article, I’ll dig deeper into Legg Mason to determine whether or not we should follow Mario Gabelli into this company.

Legg Mason, incorporated in 1981, is the global provider of investment management services to institutional and individual clients, with about 3,000 employees and 31 offices around the world. Legg Mason conducts its business mainly through 12 asset managers, including Batterymarch Financial Management, Brandywine Global Asset Management, Legg Mason Capital Management, Royce & Associates, and Western Asset Management Company.

Legg Mason is considered one of the most diversified asset management firms in the world, with around $654 billion in assets under management (AUM) as of December 2012. The two biggest revenue contributors were Fixed Income (41%) and Equity (41%). The majority of assets was invested in fixed income, accounting for 57% of the total AUM, while Equity and Liquidity represented 22% and 21% of the total AUM, respectively. As the majority of the AUM, 72% of the total AUM, was from institutions, the AUM was considered quite sticky. However, Legg Mason has been facing challenges for several years as investors have been pulling money from its funds. The AUM has decreased from $1 trillion in the beginning of 2008 to $654 billion. In the third quarter of fiscal year 2013, the net outflow was around $7.5 billion.

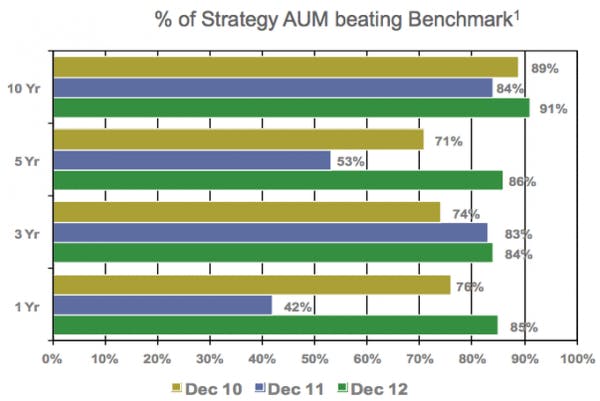

High Percentages of AUM Beating Benchmark

In order to evaluate an asset managers’ capabilities, we should look at their performances in a 5-10 year period to see whether or not their results beat the benchmark. In a 10-year period, Legg Mason has had significantly high percentages of its strategy AUM beating the benchmark.

Source: Legg Mason’s presentation

Legg Mason has had 89%, 84% and 91% of its strategy AUM beating Benchmark at the end of 2010, 2011 and 2012, respectively. As of December 2012, the performance looked great in all four periods of 1 year, 3 years, 5 years and 10 years.

Recently, Legg Mason appointed Joseph Sullivan to be a new CEO. It seems to be a decent move, as Sullivan has spent nearly all of his life working for Legg Mason. Sullivan has been committed to Legg Mason’s turnaround. For instance, he has discussed equity offering for the firm’s executives. Sullivan commented that offering equity to managers would give them real ownership, which could help to recruit and retain executives.

Gabelli Increased His Stake

Gabelli liked Legg Mason, as the firm has kept buying back its stocks. The firm has reduced its number of shares outstanding from 164 million to only 128 million. In addition, it also announced that it would spend two thirds of the cash flow to repurchase more stock. Gabelli said: “They’re in the investment business, great cash generator, and they’re solving a lot of their issues.” On Feb. 8, Gabelli increased his stake in Legg Mason by more than 32%. Thus, he owns more than 4.9 million shares, accounting for more than 3.8% of total shares outstanding.

Peer Comparison

Currently, Legg Mason is trading at $27.60 per share, with a total market cap of $3.56 billion. Legg Mason is considered the smallest company compared to its other peers, including BlackRock, Inc. (NYSE:BLK) and Charles Schwab Corp (NYSE:SCHW). Blackrock is the biggest company, with a total market cap of $41.77 billion, while Charles Schwab is worth $21.4 billion. Among the three, Legg Mason seems to be the cheapest with 12.95x forward earnings and 0.73x book value. At the current trading price of $243.80 per share, BlackRock is valued at nearly 14x forward P/E and 1.69x book value. Charles Schwab has the most expensive valuations, at 19.3x forward earnings and 2.51x book value. BlackRock has a much higher amount of AUM Legg Mason does, at $3.79 trillion in the fourth quarter of 2012. Among the three, Charles Schwab is paying the lowest dividend yield at 1.4%, while the dividend yields of Legg Mason and BlackRock are 1.6% and 2.8%, respectively.

Foolish Bottom Line

Legg Mason seems to be quite cheap in both absolute and relative valuation measures. It is trading at 30% discount to the book value and it has the cheapest valuation among its peers. As the new but experienced CEO commits to turning the business around, I think Legg Mason’s stock price might be driven higher in the near future.

The article This Global Asset Management Firm is Cheap originally appeared on Fool.com and is written by Anh HOANG.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.