Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we publish an article with the title “Recession is Imminent: We Need A Travel Ban NOW”. We predicted that a US recession is imminent and US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. Our article also called for a total international travel ban to prevent the spread of the coronavirus especially from Europe. We were one step ahead of the markets and the president.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. At Insider Monkey, we pore over the filings of nearly 835 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of December 31. In this article, we will use that wealth of knowledge to determine whether or not Lam Research Corporation (NASDAQ:LRCX) makes for a good investment right now.

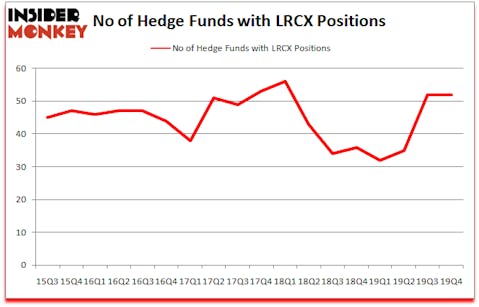

Lam Research Corporation (NASDAQ:LRCX) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 52 hedge funds’ portfolios at the end of December. At the end of this article we will also compare LRCX to other stocks including The Progressive Corporation (NYSE:PGR), BCE Inc. (NYSE:BCE), and Ross Stores, Inc. (NASDAQ:ROST) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of methods market participants use to assess stocks. Two of the most useful methods are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outperform the S&P 500 by a healthy amount (see the details here).

Noam Gottesman of GLG Partners

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind we’re going to take a look at the recent hedge fund action regarding Lam Research Corporation (NASDAQ:LRCX).

How have hedgies been trading Lam Research Corporation (NASDAQ:LRCX)?

At Q4’s end, a total of 52 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LRCX over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Cliff Asness’s AQR Capital Management has the most valuable position in Lam Research Corporation (NASDAQ:LRCX), worth close to $540.6 million, amounting to 0.6% of its total 13F portfolio. The second largest stake is held by Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital, with a $350.4 million position; 0.8% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism encompass John Overdeck and David Siegel’s Two Sigma Advisors, Alex Snow’s Lansdowne Partners and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Marlowe Partners allocated the biggest weight to Lam Research Corporation (NASDAQ:LRCX), around 11.06% of its 13F portfolio. Lansdowne Partners is also relatively very bullish on the stock, earmarking 6.13 percent of its 13F equity portfolio to LRCX.

Because Lam Research Corporation (NASDAQ:LRCX) has faced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there was a specific group of hedgies that decided to sell off their full holdings last quarter. Intriguingly, Renaissance Technologies sold off the largest stake of the 750 funds monitored by Insider Monkey, worth an estimated $106.9 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also cut its stock, about $21.9 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lam Research Corporation (NASDAQ:LRCX) but similarly valued. These stocks are The Progressive Corporation (NYSE:PGR), BCE Inc. (NYSE:BCE), Ross Stores, Inc. (NASDAQ:ROST), and Ferrari N.V. (NYSE:RACE). This group of stocks’ market caps are closest to LRCX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PGR | 48 | 1782118 | -5 |

| BCE | 19 | 219572 | 5 |

| ROST | 48 | 1029100 | 4 |

| RACE | 36 | 2003827 | 2 |

| Average | 37.75 | 1258654 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.75 hedge funds with bullish positions and the average amount invested in these stocks was $1259 million. That figure was $2626 million in LRCX’s case. The Progressive Corporation (NYSE:PGR) is the most popular stock in this table. On the other hand BCE Inc. (NYSE:BCE) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Lam Research Corporation (NASDAQ:LRCX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but still managed to beat the market by 1.9 percentage points. Hedge funds were also right about betting on LRCX as the stock returned -8.5% so far in Q1 (through March 9th) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.