The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded La Jolla Pharmaceutical Company (NASDAQ:LJPC) based on those filings.

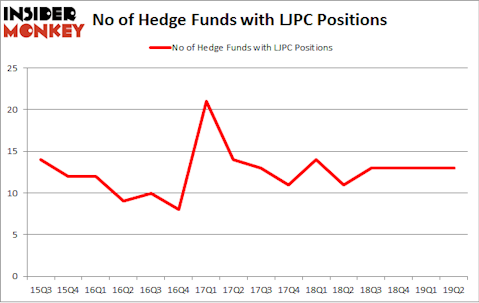

La Jolla Pharmaceutical Company (NASDAQ:LJPC) shares haven’t seen a lot of action during the second quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds’ portfolios at the end of the second quarter of 2019. At the end of this article we will also compare LJPC to other stocks including GP Strategies Corporation (NYSE:GPX), Dynavax Technologies Corporation (NASDAQ:DVAX), and Protective Insurance Corporation (NASDAQ:PTVCB) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Now we’re going to take a look at the fresh hedge fund action encompassing La Jolla Pharmaceutical Company (NASDAQ:LJPC).

Hedge fund activity in La Jolla Pharmaceutical Company (NASDAQ:LJPC)

At the end of the second quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in LJPC a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in La Jolla Pharmaceutical Company (NASDAQ:LJPC) was held by Tang Capital Management, which reported holding $45.7 million worth of stock at the end of March. It was followed by Sectoral Asset Management with a $15.3 million position. Other investors bullish on the company included Baker Bros. Advisors, Sio Capital, and Millennium Management.

Due to the fact that La Jolla Pharmaceutical Company (NASDAQ:LJPC) has experienced falling interest from the aggregate hedge fund industry, we can see that there was a specific group of hedge funds that elected to cut their full holdings by the end of the second quarter. Interestingly, Matt Sirovich and Jeremy Mindich’s Scopia Capital dropped the largest stake of the 750 funds watched by Insider Monkey, worth an estimated $3.1 million in stock, and Anand Parekh’s Alyeska Investment Group was right behind this move, as the fund dumped about $2 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to La Jolla Pharmaceutical Company (NASDAQ:LJPC). We will take a look at GP Strategies Corporation (NYSE:GPX), Dynavax Technologies Corporation (NASDAQ:DVAX), Protective Insurance Corporation (NASDAQ:PTVCB), and 22nd Century Group, Inc (NYSE:XXII). All of these stocks’ market caps are similar to LJPC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPX | 13 | 113911 | 1 |

| DVAX | 12 | 43367 | -4 |

| PTVCB | 5 | 21097 | -2 |

| XXII | 3 | 328 | 1 |

| Average | 8.25 | 44676 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $45 million. That figure was $112 million in LJPC’s case. GP Strategies Corporation (NYSE:GPX) is the most popular stock in this table. On the other hand 22nd Century Group, Inc (NYSE:XXII) is the least popular one with only 3 bullish hedge fund positions. La Jolla Pharmaceutical Company (NASDAQ:LJPC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately LJPC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LJPC were disappointed as the stock returned -4.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.