JPMorgan maintains a list of focus stocks with overweight and underweight ratings, picked by the firm’s industry analysts. All focus stocks have a potential to produce annualized total returns of more than 20% (stocks with overweight ratings) and more than -20% (stocks with underweight ratings). JPMorgan publishes target prices for all its focus stocks, so potential gains/losses on each of the focus stocks can be determined in advance. Stocks with an overweight rating are usually value or growth plays. Sometimes, these focus stocks represent good dividend investment opportunities. Here are five focus stocks that pay dividends and promise notable capital gains. Please note that some of them have been added a while ago, so that the remaining gains potential is sometimes below the aforementioned 20%.

Pfizer (PFE) is a $170 billion U.S.-based multinational pharmaceutical company. The company’s stock was added to the focus list in August 2011 at the price of $17.60 a share. Since then, the stock has appreciated some 28.5%. With a target price of $25.00 a share, there is a potential for an additional 10.5% capital gain by the end of the year. The company was added to the focus list as a “solid defensive stock to own during an uncertain market environment.”

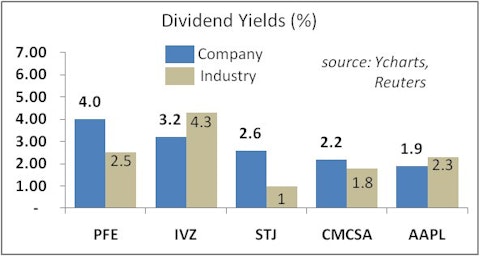

Pfizer has the fourth highest dividend yield among The Dow Jones Industrial Average companies. Its 4.0% yield is 150 basis points above the average industry yield. The company’s competitors Merck & Co. (MRK), Johnson & Johnson (JNJ), and Abbott Laboratories (ABT) pay yields of 4.4%, 3.8%, 3.3%, respectively. Pfizer has a dividend payout ratio of 72%. The stock carries a premium relative to the industry partly due to its robust pipeline of several drugs in early-stage trials targeting Alzheimer’s disease. One drug, bapineuzumab, is expected to succeed in the Phase III trial and could generate substantial revenues in the coming years. Among fund investors, billionaires Ken Fisher and George Soros remain upbeat about the stock (see George Soros’ stock picks).

Invesco Ltd. (IVZ) is a $9.8 billion independent investment management company. The stock of this asset manager was added to the focus list in June 2009 at the price of $15.65 a share. Since then, the stock has gained some 41% in value. With the target price of $30.50 a share, the stock could produce an additional capital gain of 38.3%. The company was added to the focus list because it represented “an unusual opportunity to buy the shares inexpensively.” Until recently, the company has benefited from a weak dollar, a stringent cost discipline, and expansion through acquisitions.

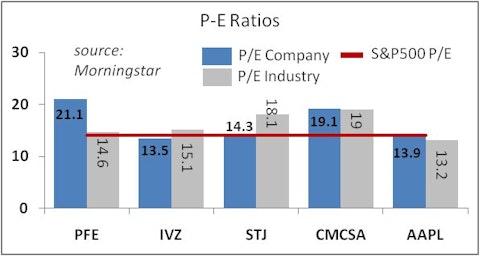

Invesco pays a dividend yield of 3.2%, higher than that for the S&P500 but 110 basis points below the average yield in the industry. The company’s peers, namely Legg Mason (LM), T. Rowe Price Group (TROW), and BlackRock, Inc. (BLK), yield 1.8%, 2.3%, and 3.4%, respectively. Invesco has a dividend payout ratio of 43%. The stock is priced below its own five-year average P-E ratio and the industry average ratio. Among fund managers, the company is popular with Andreas Halvorsen, who holds a 5.6% stake in this asset manager.

St. Jude Medical (STJ) is an $11.2 billion global manufacturer of medical devices. The company’s stock was added to the focus list in July 2011 at a price of $47.81 a share. The stock has since lost more than a quarter of its value, but still has a potential to rally to $48 per share by the end of 2012. That would represent a 35% capital gain from the current price levels. The stock was added to the focus list after the company reported 2Q 2011 results and lowered its second-half guidance, which in the opinion of JPMorgan was “a clearing event for the stock.” JPMorgan concluded that “for the first time in months the Street can … start to focus on the new product and new market driven growth acceleration story on tap for 2012.” At the time, JPMorgan saw “several catalysts into year-end.”

St. Jude Medical pays a dividend yield of 2.6%, some 160 basis points above the average yield of the medical devices industry. The company has a low dividend payout ratio of 35%. The medical device maker’s rival Medtronic (MDT) pays a dividend yield of 2.6%, while Boston Scientific Corporation (BSX) does not pay dividends. St. Jude Medical’s stock is currently trading well below its own five-year average P/E and the industry’s earnings multiple. Jim Simons’ RenTech is an investor in the company, although the hedge fund significantly reduced its stake in the first quarter of 2012.

Comcast Corporation (CMCSA) is a U.S.-based entertainment, information, and communications products and services company. It has nearly $84 billion in market capitalization. The company’s stock was added to JPMorgan’s analyst focus list in October 2011 at the price of $20.36 a share. Since then, the stock has gained 52.6%. The stock has a target price of $35 by the end of 2012, which implies a potential for an additional 12.7% capital gain. The stock was added to the focus list because the company “was expected to see strong cash flow in 2011 and 2012, as its internet and phone subscribers rose and advertising revenue at its NBC Universal joint venture improved.” The company has ample cash flow that it can use not only to buy-back shares and pay dividends, but also to reduce leverage significantly.

Comcast pays a dividend yield of 2.2% on a payout ratio of 40%. The company’s peers DirecTV (DTV) and Dish Network Corp. (DISH) do not pay regular dividends. In terms of valuation, the company’s P/E is almost on par with that for the industry, but well above the company’s own five-year average ratio. Fund manager Lee Ainslie of Maverick Capital is an investor in the stock.

Apple Inc. (AAPL) has a market capitalization of $537 billion and is the largest publicly-traded company in the world. The company’s stock was added to the focus list in July 2010 at a price of $251.53 a share. Since then, the stock has increased almost 2.3 times. Based on JPMorgan’s target price, there is a potential for the stock to rally another 30.6% by the end of the year. The stock was added to the focus list as “an unparalleled growth” story, with sales of the iPhone and iPad showing explosive growth. JPMorgan also cited “untapped international opportunities for the Mac.”

Apple is expected to start paying a regular quarterly dividend of $2.65 a share in its fiscal fourth quarter which begins on July 1, 2012. At current prices, the annualized dividend will yield 1.9% on a payout ratio of 26% of trailing-twelve-month earnings. Apple’s competitors Microsoft (MSFT) and Hewlett-Packard (HPQ) pay dividends yielding 2.6% and 2.5%, respectively. Competitor Google (GOOG) does not pay any dividends. Apple’s stock seems to be priced slightly above the industry, but well below its own five-year average multiple. Guru fund managers David Einhorn, David Tepper, and Dan Loeb are bullish about the company (see David Einhorn’s stock picks).