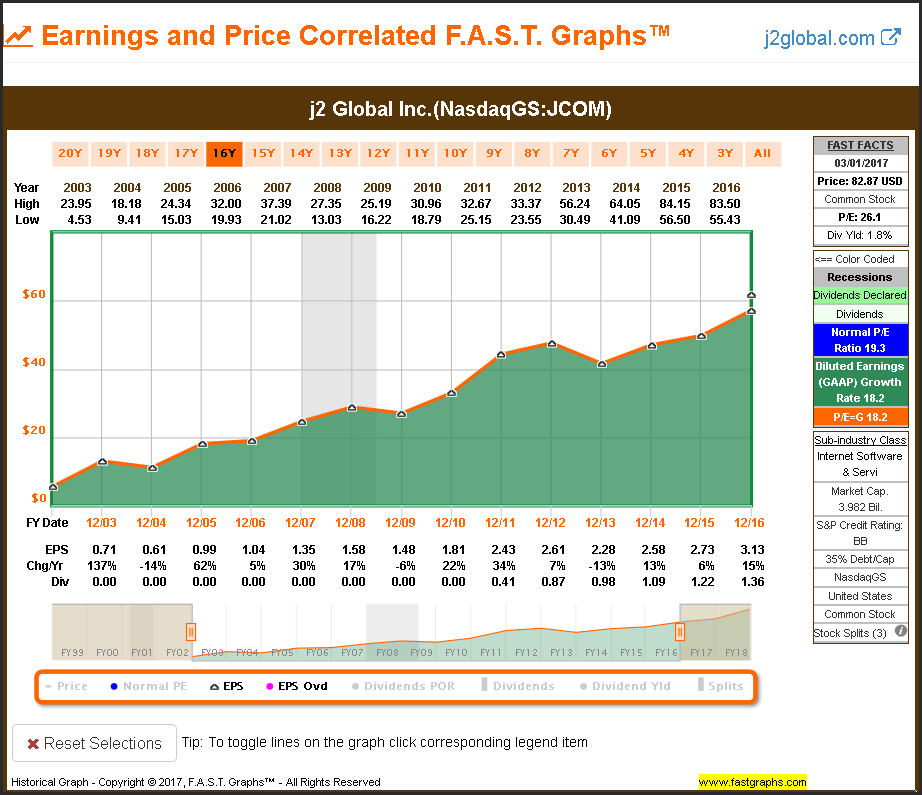

Personally, I prefer evaluating a stock based on non-GAAP adjusted earnings and/or cash flows. The reason I prefer adjusted earnings is because I feel they more practically reflect how the business is performing on an operating business. This is in contrast to GAAP (diluted) earnings which may include significant one-time accounting events and/or non-cash charges. However, for the GAAP earnings purists out there, j2 Global’s historical diluted earnings record is also quite impressive. This is especially true when you consider that this company engages in significant merger and acquisition activity.

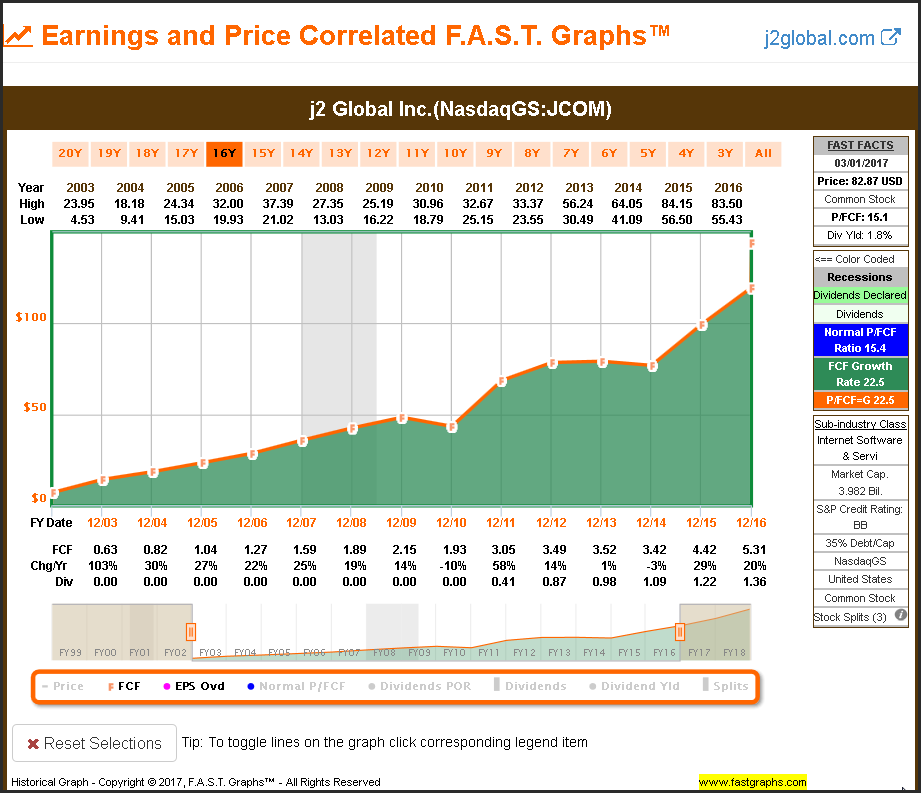

Additionally, an examination of a company’s record of free cash flow generation can also be quite revealing. This is the measure of the company’s financial performance calculated as operating cash flow minus capital expenditures. In other words, this is the cash flow left over after the company has spent the necessary money required to maintain or expand its business. j2 Global’s historical record of generating free cash flow is also quite impressive.

F.A.S.T. Graphs Video: Offering A More Comprehensive Look At j2 Global’s Fundamentals and Dividend Paying Capacity

Summary And Conclusions

I believe that investors should make investment choices that meet their specific objectives. Moreover, once made, I believe those investment choices should be judged based on meeting the objective they were chosen for. For example, if the investor was desirous of achieving the highest current yield available, they should also recognize that this might limit their capital appreciation potential. It is very rare to find investments that offer both high-yield and high-capital appreciation potential. But perhaps more importantly, on the rare occasions where both might be present, the risk is typically also higher.

Consequently, for the investor seeking high yield, it only makes sense to me that their focus should be on the income that the investment is throwing off. Capital appreciation, if any, should be considered a side effect or bonus under those conditions. In other words, I believe it’s important, and only makes sense to be realistic with your expectations.

The reason I bring this up is because my personal investment quest currently is looking for fairly valued dividend growth stocks with yields exceeding 3%. Unfortunately, I have been very frustrated in identifying many large blue-chip dividend stocks that meet my quality standards and valuation requirements in today’s low interest rate environment.

As a result, I’ve been forced to look beyond the normal channels of Dividend Aristocrats, Champions or Contenders. Unfortunately, expanding my universe has continued to provide few investment opportunities under that criteria. On the other hand, and perhaps more fortunately, it has opened my eyes to other currently attractive investment opportunities such as J2 Global Inc (NASDAQ:JCOM).

When I came across j2 Global as I searched for high quality dividend growth stocks, I could not help but be impressed by what I saw. Therefore, I thought it was also worthy of sharing this moderately yielding but high total return potential research candidate with my regular readers. Therefore, if your investment objective is high total return with a growing dividend kicker, then j2 Global might just be what the doctor ordered.

If you enjoyed this article, scroll up and click on the “Follow” button next to our name to see updates on our future articles in your feed.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Note: This article is written by Chuck Carnevale and was originally published at FASTgraphs.com.